Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

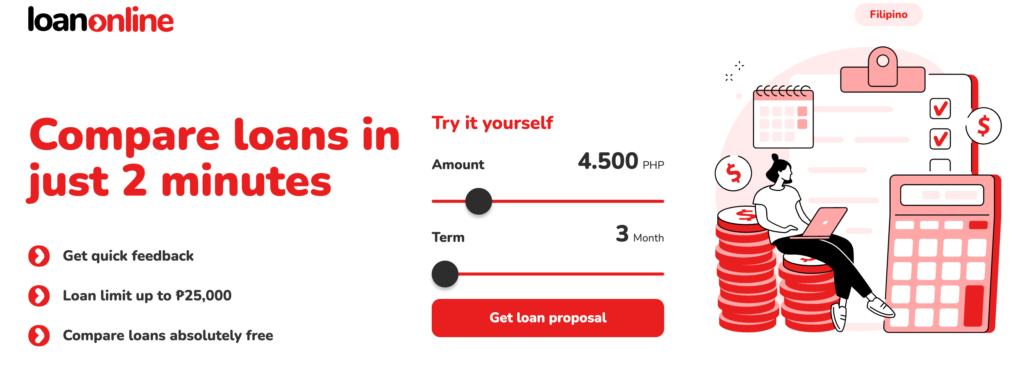

- Loan amount up to PHP 25.000

- Loan period from 1 - 12 months

- Interest rate from 0,01% and higher

- Citizenship Filipino

- Age 20+

- SEC registration no need

- You can quickly find out where you can apply for the loan online in the Philippines

- You can compare loans for free

- Onlineloans.ph doesn´t provide loans, only recommend some lenders

- It is online broker and such companies mainly are focused to earn money

Loanonline Philippines – is an online broker that helps Filipinos to find the right loan service for urgent needs. If you don´t want to use a broker service, for sure you can apply to the ending company directly.

Table of Contents

How Loanonline Philippines Broker Works

To get your money you need:

- Go to the website: https://www.loanonline.ph;

- Click on the button “get loan proposal”;

- After it adds your contacts (brokers gather contact information in order to provide some email and SMS newsletters);

- After it you will see some information about lenders whom Loanonline.ph recommends choosing;

- You choose the lender you´d like and click on the “apply” button.

This part is only on broker side, further you need to continue and apply the loan on the lender´s website which will provide you with the loan online in the Philippines.

After you finish your way on the broker´s website, you will get to the exact lending service you choose and there you will need to do the next:

- After choosing the loan service you will need to choose the loan sum and period;

- Go through the registration with SMS verification;

- Add your personal information;

- Apply for the loan;

- Get approval and read all terms, if everything is ok, you agree with them;

- Then, you will get your money online or another way you choose;

- But, don´t forget to repay the loan in time, in order to avoid penalties, fines, and other financial problems.

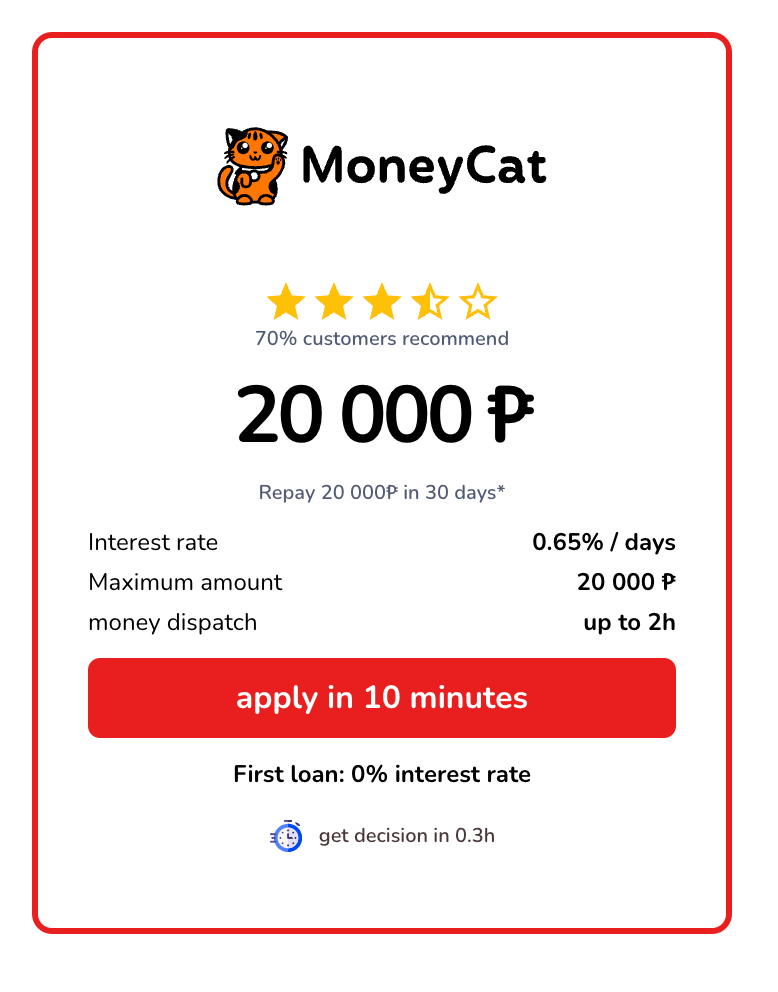

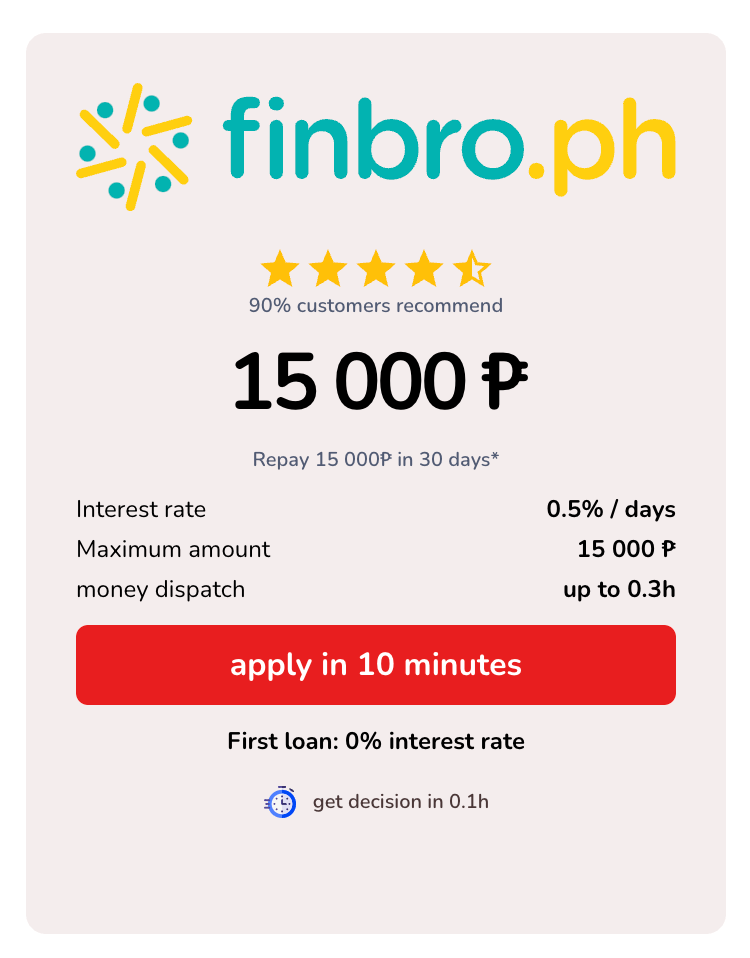

The Most Popular Loan Services That Broker Recommends

There are several lenders in the Philippines which are very popular and the brokers recommend using them most of all. For example, Digido Philippines where you can apply for a loan up to PHP 25.000, but for the 1st time only up to PHP 10.000 for the period of 30 days.

You can apply for a loan with the website or Digido mobile app, but very important to say, that the 1st loan is with a 0% interest rate.

Broker Contacts

This is all information we have found, possibly with time will be more, but if you want to ask some additional questions to the broker´s support team, just write them email:

| Company | Loan Online Philippines |

| Website | https://www.loanonline.ph |

| support[@]loanonline.ph | |

| Phone | N/A |

Loanonline.ph Reviews

No reviews about service at all, so it is difficult to say about it some good or bad words, but the broker service is free for users. Don´t forget, that brokers are interested in earning money or monetization their services. So, before applying for the loan in the exact loan service, please read about one maximum information reviews, terms, requirements, is it legal and registered in SEC or not, etc.

For sure, if you have some feedback about the Loan Online Philippines broker, please write you thoughts in the comments lower. It will be interesting for other people.

FAQ About Loanonline PH

If you have some additional questions, you can find some answers lower or just write your question in the comments section, we´ll try to help you.

✓ Is Loanonline PH Legal?

Yes and no. Yes, because loan brokers don´t need any SEC registrations, etc. No, because they have no documents, even entity information is not presented on the website https://www.loanonline.ph;

✓ What Are The Alternatives Loan Brokers In the Philippines?

✓ How Can I Apply For A Loan, If I Don´t Want To Use Loanonline PH Service?

In this way, you can just go to the list of lenders in the Philippines and choose the best you´d like.