With Tonik you can apply for a quick loan in 30 minutes and up to PHP 50.000. Everything is secured and no collateral is needed. So, you can apply for a quick loan, flex loan or shop installment loan with Tonik bank very easily.

- Loan amount from PHP 5.000 to PHP 50.000

- Loan period 6,9,12,18,24 months

- Documents 1 major valid ID

- Citizenship only Filipino

- Age 23+ years

- Payroll card if you want to have lower commission

- No collateral and credit history needed

- Quick process - up to 30 minutes

- Enough flexible payout dates

- Everything is online - 100% digital

- You can cash out 100% of the full loan

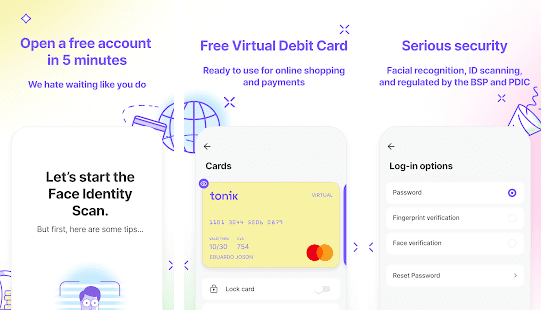

- Tonik App and card is very secured and reliable

- Lock card feature

- Very comfortable app, you can use your password of face id

- Everything is secured, also bank monitor fraud activities

- Limits management, you can control spendings every day

- Enough high interest rate - 7%, but it can be lower, if borrower link salary payroll with ATM card

- No pre-termination

Tonik bank – the 1st neobank in the Philippines. This review will be about Tonik financial services and how they can help Filipinos in their life. In order you could use bank services, you need to download the Tonik apps, but all details lower, please read about it and discover the bank right now.

Bank provides innovative Fintech products to Filipinos at great terms. Bank started with savings /deposit products and currently has loan products, such as quick loans, flex loans, shop installment loans, and big loans. Currently, neobank is very trending in the Philippines and we really recommend you try one financial product and download Tonik apps Android / iOS depending on your smartphone.

| Age | 18+ years |

| Residence | in the Philippines |

| Email and Phone | only valid |

| Not classified under the USA FATCA | yes |

| Documents | Government ID |

Table of Contents

Tonik Bank Philippines

Neobank has many services and opportunities for Filipinos: loans, deposits, savings, etc. Here we’ll tel you in more details about each direction.

The bank gives the opportunity to register anyone who is interested in one service.

For registration you need:

- Download and install Tonik mobile application;

- To go through the registration process and add all the required information.

Tonik Loan Review Philippines

The company launched the credit products only in September 2021. The terms for clients for sure are much better than other lenders have in the Philippines. You can apply for a credit up to PHP 50000 with an interest rate – of 5,42% – 7%. For this, you need to download the Android or iOS application and follow the instruction, but before that, let´s discover all bank credit products for Filipinos.

Tonik Quick Loan

No collateral and credit history is needed for a quick loan. Fast approval. Credit amount up to PHP 50.000 for a period of 6 – 24 months. It is a 100% digital loan. One has a fixed interest rate of 7,00% per month.

Tonik Flex Loan

You can get money quickly and save at a low-interest rate. Don´t forget, that the time of loan approval depends on the customer and how quickly he/she will provide all required documents. Flex Loan is for employed customers. Approvals in 1 day or quicker.

We can highlight several advantages of this product:

- Enough high maximum credit amount, up to PHP 250.000 from 6 to 24 months installment period;

- No hidden fees, so all terms are transparent;

- All data is protected.

How to get a Flex Loan:

- Download the Tonik Android/iOS app – you need to get an account and only after you will be able to choose the Flex Loan;

- Upload all documents – follow all the instructions;

- Get the offer – read all terms, if everything ok for you, agree to one and sign the documents;

- Just wait for your money – it will be realized asap when the bank will confirm your Flex Loan application.

Flex Loan requirements:

| Nationality | Filipino |

| Age | 23 – 58 years |

| Minimum monthly income | PHP 15.000 |

| Documents | Major valid ID, Proof of income, TIN, |

| Savings account | yes |

| Payroll statement account | yes |

| Payroll ATM | yes |

Big Loan

It is really great opportunity for all Filipinos to get up to PHP 2,500,000 in 7 days! You can realize your big dream. Goals can be different: pay tuition fees, realize some home improvement project, to buy a new car or motorcycle, you can start your own business, etc.

| Amount | PHP 2,500,000 |

| Period | up to 60 months |

| Pre-approval | 30 minutes |

| Credit card | not required |

| Credit history | not required |

How to get a big loan:

- Download the Tonik app;

- Go through the registration process;

- Choose the big loan in your account and fill in all the necessary information;

- Up to 30 minutes you can be pre-approved for the big loan;

- Further, upload, pleaser all required documents;

- Wait for a call from the bank team to discuss everything;

- Wait for approval from the bank;

- Bring all needed documents;

- Get your money;

- Repay your credit according to the payment schedule.

Requirements:

| Documents | Valid ID, Marriage Certificate |

| Statements and pay slips | For the last 3 months |

| Condominium Certificate of Title | Scan copy needed |

| Photos of your condo unit | Needed |

Shop Installment Loan

Shop installment loan can be up to PHP 100,000 with APR 54%. Credit period from 3 to 24 months.

The credit period can be up to 24 months (2 years). In reality, you can apply for a loan quicker than 30 minutes. A quick credit from the bank is a really new product for Filipinos which will improve all lending markets in the country. The focus is on unbanked and middle-class Filippino whose bank offers affordable loans. To apply for a quick loan you don’t need much, just 1 valid ID and the latest payslip. All credit decisions bank makes fast with AI system. The fund’s borrower can receive on a Tonik card, withdraw through OTC partners or e-wallet account, etc.

Also, if compare the neobank with traditional banks, the last one requires applicants to have already some credit history, but 70%+ don’t have one. This is the main reason why Filipino have to borrow money from their relatives or go to payday and installment loan providers which have high-interest rates.

Such situation damages long-term financial stability of people in the Philippines and this is not so good. Of cause, unsecured loans can be interesting with 0% interest rates, but the point is to repay in time. Many people can’t do this but they apply such salary loans again and again. The Bank will help to make situation better with one credit product in the Philippines.

Tonik Bank Time Deposit

A great option to start investing money into your future. You can start from PHP 5000 and choose the period you need, for example, 6 months. Everything depends on your short- or long-term goals. Want to know more, you can try the Bank Time Deposit calculator.

| Annual interest rate | 6,00% |

| Access to the money | anytime |

| Document Stamp Tax | No |

| Maximum amount | PHP 250.000 |

For example, if you start a deposit with PHP 10000, you will see next results:

| Deposit period | Interest rate | You will earn |

|---|---|---|

| 6 months | 6,00% | PHP 302.47 |

| 9 months | 4,50% | PHP 336.58 |

| 12 months | 4,75% | PHP 475.00 |

| 18 months | 5,00% | PHP 752.05 |

| 24 months | 5,25% | PHP 1.050.00 |

- Deposits are insured by PDIC, the amount is up to PHP 500.000 per client;

- Early withdrawal even in 5 days will give you 1%

Cash In A Stash With Bank

You can do some savings solo or with a team for your different needs like vacation, gifts, emergency cases, etc. You choose your own stash goals.

| Solo stashing | 4,00% interest rate |

| Group stashing up to PHP 500.000 | 4,50% interest rate |

How To Open A Group Stash:

- Open the app and log in;

- Click to create a group stash;

- Invite other friends (minimum 3);

- All members should contribute money;

- Withdraw money can only stash the owner, so he or she should be responsible.

Virtual Debit Card From Tonik Bank Philippines

With a debit card, you can easily realize transactions online. It works fast and reliably. All information will be in the app, so you for sure will be able to control everything about your spending. Do your shopping at a good time for you. Pay your bills on time. Transfer money and stay tuned. If you lose your card, no problem with it, you can block it in the app and order a new one. If you need cash, ATMs can help you with it.

ATM fees:

| ATM balance inquiry | free |

| ATM withdrawal | free |

| The card price | PHP 200,00 |

| Delivery price | PHP 100,00 |

Tonik Bank App

Neobank is focused to build great relationships with clients, so scammers will be tired to repeat the success of the bank. All data is secured, so users will have a sure great experience using the Tonik app on Android or iOS. Bank has enough good security systems, so you can rely on the bank.

Requirements for the phone in the order you could use the Tonik app:

- For IOS users system requirements iOS 10.0.0 or higher;

- For Android users system requirements Android OS version 7.00 or higher;

- The front-facing camera must;

- RAM of your phone – 3 GB or more.

What Are the Transaction Fees

| Channel | Cash-in | Cash-out |

| InstPay | depends on the bank | free |

| PESOnet | depends on the bank | free |

| Local Bank Debit Card | 2,50% | N/A |

| CLIQQ | PHP 30,00 | N/A |

| UnionBank Direct | PHP 30,00 | N/A |

| 7-Connect | PHP 30,00 | N/A |

| Other Account | free | free |

| Cebuana | PHP 30,00 | PHP 50,00 |

| MasterCard ATMs* (debit card) | N/A | N/A |

| BPI Direct | PHP 30,00 | N/A |

| M. Lhuillier | PHP 30,00 | PHP 50,00 |

| SM Business Center | PHP 30,00 | N/A |

*Besides, ATMs access fee can be PHP 250,00; also, other banks can charge additional fees.

Tonik Contacts

If you have some additional questions you can write/call the bank anytime you need:

| Company | Tonik Digital Bank, Inc. |

| Website | https://tonikbank.com |

| Hotline | +63253222645 |

| customercare[@]tonikbank.com |

Address: Philippines, Unit 605B, 6/F West Wing, The Offices at Estancia, 1605 Meralco Ave, Pasig City

Tonik Financial Pte Ltd – a holding company based in Singapore. All operations are conducted with the local subsidiary Tonik Digital Bank Inc. 40% of the local subsidiaries are owned by local investors.

Tonik Bank Reviews

If you had already the opportunity to use the bank service, please share your experience in the comments lower. It will be interesting for other Filipinos.

Neobank is very new, that’s why their app could have some bugs in some cases, but they fix everything very quickly, so suppose in 1 month or quicker no old issues will be left.

FAQ About Tonik

⭐ Is Tonik Bank Legit?

Yes, Tonik is the legal neobank in the Philippines with a license from the Bangko Sentral ng Pilipinas (BSP).

⭐ What About Tonik Loan and Interest Rate?

The bank can offer you a credit in 30 minutes up to PHP 50000 from 5,42% – 7% per month interest rate. If you need alternatives, you can check payday companies: Digido, Cashxpress, and Tala, but these companies have higher interest rates and penalties if the borrower doesn’t pay in time;

⭐ Can I Use Credit Card?

Currently, you can get a debit card, but credit options are also available. To use it, you need to download the Tonik app.

⭐ Why Tonik Card is Secured?

1) It has a lock card feature, so you can prevent unauthorized usage of your card just in several clicks with the help of the app;

2) You can control and manage your limits – just select you’re desired daily spending;

3) Face ID – the app is secured, so this option helps to avoid unwanted access;

4) There are systems that monitor fraud activity and control all data secured;

5) Well, you can easily block your card and re-issue new one if you want to update it and be sure your account is safe;

⭐ What Do You Need To Know About App Account?

There you will be able to control all your activities about credits, deposits, etc. All necessary information will be in your app, so don´t worry, it works for you 24/7.

Tonik Digital Bank Inc.

Name: Tonik Bank Philippines

Description: Tonik Digital Bank, Inc. is regulated by the Bangko Sentral ng Pilipinas. Neobank provides different financial services of high level to Filipinos. Tonik is the 1st neobank in the Philippines. Bank is not limited by physical branches.

Summary About Tonik in the Philippines

Tonik is the Digital Bank that is focused on Southeast Asia. It launches new services very actively. The core is Tonik mobile application. With one, you can control all your financial operations. In 2021 over 70% of the Philippines are unbanked and this is a great opportunity for the neobank to change the situation and improve people’s lives. The bank is launching retail financial products: deposits, credits, payments, cards, etc. The customer is in 1st place for Tonik – officially the 1st neobank in the Philippines which has a license and deposits are insured by the Philippine Deposit Insurance Corporation (PDIC).

I`ve had a debit card in this bank for 5 years. I don’t like the app a little bit, for me it’s inconvenient, a lot of unnecessary things. Sometimes freezes for 20-30 seconds. Concerning loans…not bad. Low interest…The amount was approved by the one that I asked for, but it took 6 days to wait. It`s not a quick process. I know it cause my college took loan in other bank. She was approved for in 1 hour.

Tonik Bank was launched not so far “TONIK Digital Bank Inc, founded in 2018, received its banking license from Bangko Sentral ng Pilipinas (Philippines’ Central Bank) in January 2020. “

Thanks

Please send all my fund to my RCBC savings bank account…