Home Credit Philippines - allow you to shop the products you need with installment loans. Buy now and pay later with the Home Credit mobile application. The process is fast and convenient. Check terms now.

- Loan amount from PHP 3.000 - PHP 150.000

- Loan period 3 - 60 months

- Interest rate (APR) 24% - 77%

- Processing fee (Visa/MC Debit card) 3.8% of transaction amount

- Processing fee (BPI) 1.5% of gross transaction amount or PHP 20

- Processing fee (Unionbank) 1.5% of gross transaction amount or PHP 20

- Fixed Processing Fee: (deducted from amount to be disbursed, not on top of loan amount) PHP 500

- Employment 3+ months, self-employed, etc

- Age 18 - 68 age

- Citizenship only Filipino

- SEC Reg. Number CS201301354

- Certificate of Authority Number 1071

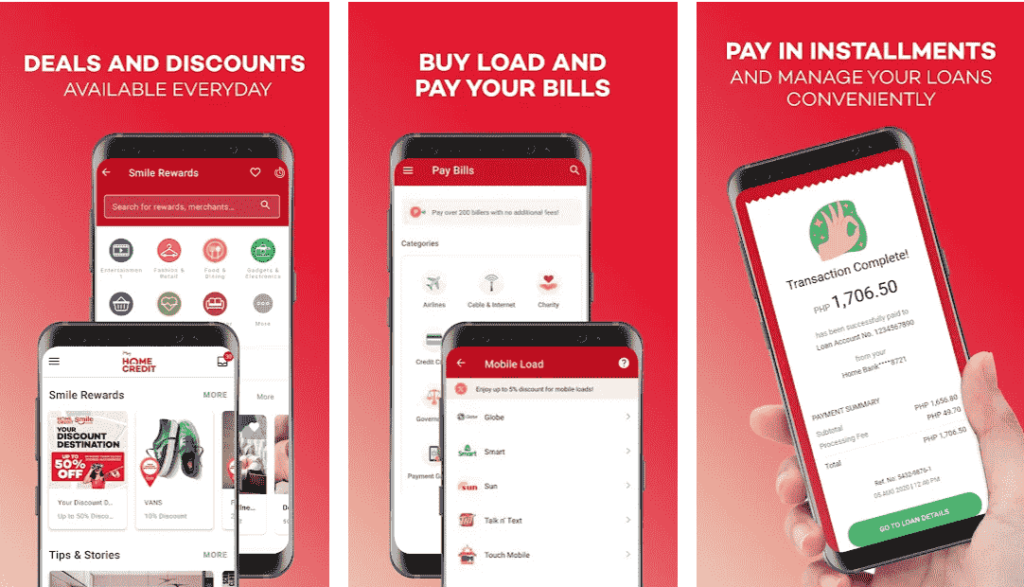

- Home Credit has the mobile app, which is enough convenient

- You don´t need credit card

- You don´t need collateral

- All process is online via website or mobile apps Android, iOS, Huawei

Home Credit Philippines provides Filipinos with a cash loan or product loan in an instant. With the app, you can apply for your loan with several clicks. The service is trusted by millions of Filipinos—over 5+ million downloads. Home Credit philosophy is about responsible lending. Loans should be affordable and installment plans – flexible. You don´t need a credit card. You don´t need collateral!

With Home Credit, you can easily apply for a cash loan or loan online. You need money for your new phone or you want to buy some gadget, or something else – no problem. Just apply for a loan with the help of the app. You can do your shopping in installments, check Home Credit Marketplace. With the help of the app, you can easily manage your payments 24/7. Also, there is an option for automated repayment, and for this, you need just add your bank card. This will allow you not to miss your payment and it is really a very convenient function.

By the way, you can explore cool promos and discounts from Home Credit Philippines!

Table of Contents

Home Credit Philippines

How To Apply Loan Offline With HC

- You need to prepare 2 valid IDs, one of them must be major;

- Visit one of the stores which are the partners of Home Credit Philippines and choose the goods you want to buy;

- Purchase what you want, and the sales agent will assist you and help with everything;

- Downpayment – sign the contract and get what you want;

- Split the remaining costs into installment payments and repay your loan according to due dates.

Check the sample calculation:

| Loan amount | PHP 15000 |

| Period | 1 year or 12 months |

| Interest rate (minimal) | 1.99% per month |

| The processing fees (fixed) | PHP 500 |

| The monthly installment will be | PHP 1418 |

| The total loan cost will be | PHP 17516 |

Requirements From HC PH

Home Credit Philippines requirements are not so strict, as in banks, but in order, you could have more chances to get the loan, you need to follow them:

- Your age should be from 18 – 68 years;

- You need to have 1 major ID and 1 secondary ID;

- Stable income is the obvious option: employment, business, remittances, pension, etc;

Installment Loan In A Minutes

With the help of Home Credit Filipinos can buy different products using installment loans: cellphones, computers, appliances, TVs, electronics, furniture, scooters, musical instruments, sporting goods, etc.

You can go to the Home Credit official website – https://homecredit.ph/check-eligibility/ and with the help of an installment loan calculator check your eligibility and apply for the loan you want.

- So, check your eligibility now and fill in the application form;

- Visit the nearest partner´s store – don´t forget your valid IDs;

- You will get approval in several minutes and get your goods, as you wanted.

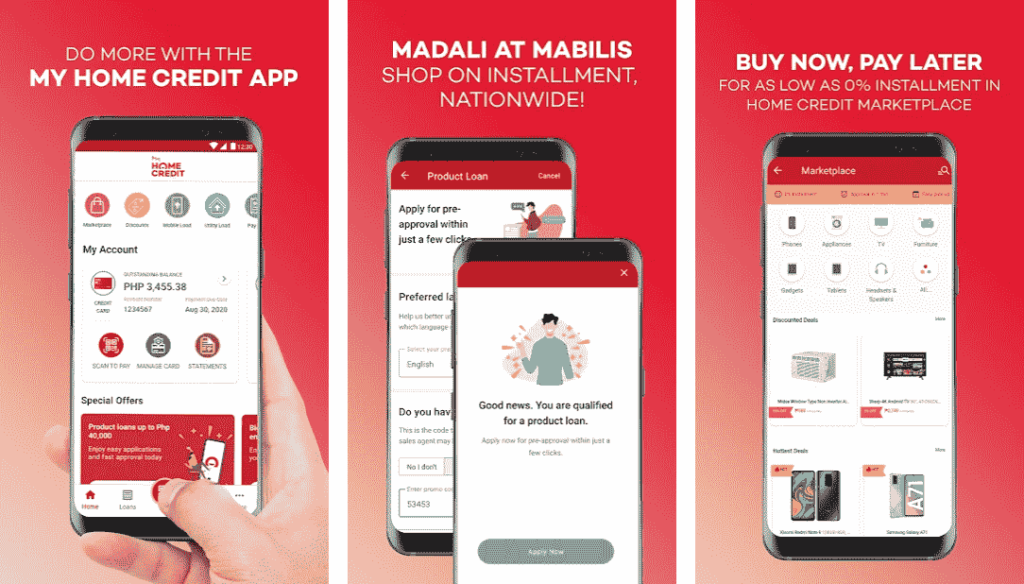

Home Credit Mobile Application

The 1st you should know about is the Home Credit Philippines app, it is free of charge. A mobile app helps you to control your loans and finances. The borrower will not miss the payment date with the app. Service will notify the user 3 days before, so he/she were able to repay the loan in time and avoid penalties. Also, you will track your payment progress and if you will need asap assistance, you can apply it again with the Home Credit Philippines mobile application.

To start using the app you should do the next steps:

- Go to the Google Play;

- Download and install the application;

- Open and register in it;

- Further, you´ll be able to apply for the loan with the Home Credit Philippines app and solve your finance issues;

- Don´t forget to repay a loan.

How can users create an account:

- For new customers, they must just choose the product at the Home Credit PH website and follow the next steps;

- For the existing customers, they have to use LAN and nominate a 4-digit PIN;

Important to know about mobile app permissions

If you want, you can deactivate the permissions which were requested by the Home Credit Philippines mobile app after the submission of any application for our services. However, certain features may not work well after it.

Home Credit Philippines app starts to gather different information about the user when one activate permissions. We talk about your location, camera, contacts, calendar, etc. You should know about it. Loan service wants to know your behavior, cause this information help company to determine the user creditworthiness. Also, the information about your behaviour will help them to avoid some fraud and collect money back.

How To Repay Loan

- With the help of banks: BPI, UnionBank;

- With the help of your cards: VISA / MasterCard;

- 7-Eleven and other department stores;

Use the Home Credit app and it will help you to solve all your issues with repayment. Quickly, easy, and in several clicks.

Home Credit Card Apply Now

Manage Your Home Credit Card – it is really easy with the app:

- Activate your Home Credit card with the app in several clicks;

- Track all your online transactions, and spending. Be aware of everything about your card;

- You can convert your purchases to the installments;

- Don´t forget to make your card secure with a reliable password.

Home Credit Marketplace

Home Credit Philippines also offers shopping via:

- marketplace;

- deals & discounts – Smile Rewards Program;

- also, you can pay your bills in the Philippines with a help of the Home Credit Philippines app.

Contacts & How To Connect With Home Credit Support Team

| Company | HC Consumer Finance Philippines, Inc. |

| Website | https://homecredit.ph |

| myhomecredit[@]homecredit.ph | info[@]homecredit.ph repayment[@]homecredit.ph | |

| Customer Service Phone | (02) 7753 5711 | (02) 8424 6611 |

| Collections Hotline | (02) 7753 5712 | (02) 8424 6612 |

| Address | Philippines, 9th Ave, Taguig, Metro Manila Ore Central Building |

Social networks:

- Facebook – https://www.facebook.com/homecredit

- YouTube – https://www.youtube.com/channel/UC_StexEi6zApg-3yFjBymww

If you have a desire to work in the company and build a career, please look through this page: https://homecredit.ph/careers/vacancies/ – it can be interesting.

Where You Can Consult & Get The Loans

| Palawan Express | from 8 am – 5 pm |

| RD Cash Padala | from 8 am – 5 pm |

| Touchpay | from 8 am – 5 pm |

| USSC | from 8 am – 5 pm |

| Bayad Center | from 8 am – 5 pm |

| Truemoney | from 8 am – 5 pm |

| Rustants | from 8 am – 5 pm |

| Villarica Pawnshops | from 8 am – 5 pm |

| Digipay | from 8 am – 5 pm |

| Cebuana | from 8 am – 5 pm |

| Mlhuillier | from 8 am – 5 pm |

| 7/11 | 24/7 (map) |

| Shopee | 24/7 |

| G-Cash | 24/7 |

| Paymaya | 24/7 |

| RCBC Online | 24/7 |

| RCBC ATM | 24/7 (map) |

| RCBC OTC | (map) |

| BDO OTC | (map) |

| BDO Online | 24/7 |

| BDO ATM | 24/7 |

| Visa / Mastercard | 24/7 |

Home Credit Philippines Review

If you have already used the Home Credit Philippines app and card, please write about it lower in the comments. Positive or negative experience, np, the main point is the truth from your side. Please, help other Filipino to be better aware of this company and one´s loan products.

As we see, over 5 mln people downloaded the Home Credit Android mobile application and this amount already means that this product is interesting to many people in the Philippines. Also, pay attention to the company´s activities in official social networks and not only. The company is live and it has a lot of employees, just check the Linkedin page.

FAQ About The Company

In October 2013 Home Credit started operations in the Philippines. The company belongs to the Home Credit Group which operates in many countries. The lender promotes principles of safe lending, striving to provide the best services to Filipinos, and helping people to solve their financial issues.

Home Credit Philippines in numbers:

- 8636+ shop partners;

- company is present in 17+ cities in the Philippines (69 provinces);

- you can find it in over 790 malls all over the country;

- over 12000 employees.

☆ Is Home Credit Philippines Legit?

Yes, Home Credit is legal in the Philippines. It is registered by SEC and has all needed licenses. Service already has over 5 million customers.

Company name: HC Consumer Finance Philippines, Inc.

Brand: Home Credit Philippines

SEC Registration # CS201301354

Certificate of Authority # 1071 (issued 07 April 2017)

☆ What Are The Primary & The Secondary IDs?

Primary: SSS, UMID, PRC, Passport, TIN ID, Voter´s license, Driver´s license;

Secondary: Postal ID, Water Bill, Phone Bill, Salary slip, Company ID, Certificate of Employment, Bank account statement, Remittance slip, PhilHealth ID, PAGIBIG/HDMF ID, etc.

☆ Who Can Use The Home Credit Philippines App?

Every customer whose age is 18+ years in the Philippines. One can get a cash loan or loan to buy some goods. Also, with the Home Credit Philippines app, you can:

1) Apply for a loan – easy and with several clicks;

2) Track your application, and all other information, so you will not need to waste your time, the solution will be quick;

3) Manage all your payments, so you were sure everything is ok, also you will have all options and information on how to repay loans with Home Credit PH;

4) You can also discover some promotions and offers with the app;

5) Support assistance 24/7 in your app, for your additional questions.

☆ What Do You Know About Home Credit Philippines Cash Loan?

With Home Credit, you can apply for a cash loan easily. Fast approval and UX process. The terms are the next:

Loan period: from 3 – 60 months

Interest rate from (APR): 24% – 77%

HC Consumer Finance Philippines, Inc.

Summary About Home Credit Philippines

Home Credit is