Binixo Philippines - is an online broker that doesn´t provide online loans, one only recommends the lender you could be interested in. Binixo PH is not responsible for your decisions, the broker only provides about lenders in the Philippines, so when you choose one, please read all terms and responsibilities on the lender´s website/app.

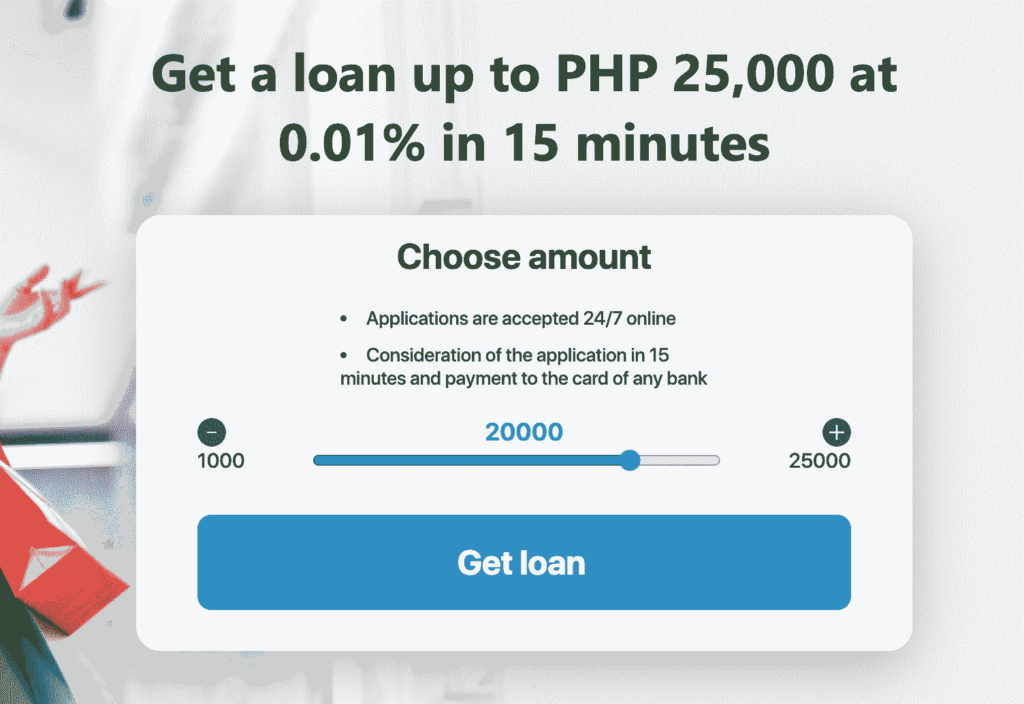

- Loan amount up to PHP 25.0000

- Interest rate according to the exact lender

- Citizenship only Filipino

- Age 18+ years

- You can find some new information about lenders

- Also, it can just help you quicker find the right company

- It is free broker, no charging

- It doesn't provide loans, only information about loan originators in the Philippines

- Brokers usually are interested to earn more

- You can get additional SMS / Emails newsletters that can make you nervous or not

Binixo Philippines – if you don´t know where you can apply online for payday or installment loans in the Philippines, Binixo service can help you. It is free of charge. With one, you can find out which lenders are active and ready to provide Filipinos with quick loans.

Table of Contents

Binixo Philippines Online Broker

How to receive money from the loan broker? The answer is – one doesn´t provide loans, only recommendations. So, if you want to get a loan, one can help only and this user should do the next steps:

- Go to the Binixo website: https://binixo.ph;

- Choose the loan amount;

- Fill in the application form;

- Get the information about some lenders with the help of which you can get a quick salary loan in the Philippines;

- Go to the lender´s website/app and apply for the loan there.

Very important: before applying the online loan, please think several times if you really need it, read all terms, requirements, because possibly there is a way you could not apply the loan and solve your finance situation by yourself or with the help of your friends / relatives.

Terms & Requirements For Receiving Binixo Loans

| Citizenship | Filipino |

| Age | 21+ years |

| Any income | Obvious |

| Collateral | No need |

Binixo loan application is only for getting additional information about lenders in the Philippines. So you could find our who actively provide micro-loans for Filipino and where you can apply in order to get your cash or online loan asap. So, if we talk about Binixo – it is just a loan broker.

As for age, better to apply for micro-loans not earlier than 21 years old, when you could have some income, even non-official. Don´t apply for a loan without any income.

Contacts You Could Need

If you have some questions to the Binixo support team you can write or call them:

| Company | Infinsacom Kft. |

| Website | https://binixo.ph |

| Phone | +36202114538 |

| info[@]infinsa.com |

So, if you will need for some reason Binixo Philippines contact numbers or other contacts, you can find them higher or on the official website.

Binixo Reviews

If you had already the opportunity to test the Binixo Philippines loan broker, please provide your feedback in the comments lower. Was it a good or bad story for you? How much time did it take? What kind of information did you get? Was it relevant?

FAQ About Binixo PH

If you have any additional questions, please write them in the comments lower.

⭐ Is Binixo Legit?

Well, yes. Binixo is not a lender, it is a broker, so one has a legal entity and doesn´t need any additional license, certifications from SEC, etc; So, Binixo isn´t registered in SEC. The broker only provides information and recommendations, but for the decisions are responsible only to the borrowers.

The company had some issues with the SEC in 2019, as we understood they thought that Binixo was a lender and they were banned, read more about it you can here.

Someone can think that Binixo is a scam, but it isn´t. It doesn´t get from your money. It only provides you with the information according to the lenders in the Philippines, but it is not a scam.

⭐ How To Apply for Binixo Loans?

You can just apply to find out more about lenders in the Philippines. Further, when you choose one with the help of Binixo PH, only there you can register and apply for an online loan;

⭐ What You Should Know More About The Binixo Philippines Broker?

Binixo online broker is free in using for customers, but one is focused not only on helping people to find the best loan services but to earn money too by getting borrowers to the exact lenders;

What does it mean?

Well, the broker only shows the information, all further responsibility for applying for the loan, and repaying one is on the borrower´s side;

⭐ What About Binixo App?

The Binixo loan app currently doesn´t exist, so you can use only the Binixo Philippines website. It is also mobile friendly, so you can do it via phone or laptop easily;

⭐ Why Should You Choose The Binixo Broker?

It is free, and if you don´t know any lenders, you can find out more about them with Binixo Philippines broker;

⭐ Example of Calculation. What is Binixo Interest Rate?

All calculations you can find on the official lender´s websites. Binixo PH doesn´t provide loans, so one has no interest rate;

⭐ Be Careful and Don´t Be Fooled, Ok?

Micro-loans belong to unsecured loans cause they are too risky for simple people. You can apply for one, but then you must repay it in time, in the order, you want to avoid problems from the exact lender. Very important customer before applying for the loan read all terms, analyze the best offers, think if he/she really need such a loan, etc. Be responsible, micro-loans can help only for a short period of time!

⭐ What Are The Alternatives To The Binixo PH?

You can try to apply for a direct lender or choose another broker, for example, Crezu Philippines.

Binixo in the Philippines

Name: Binixo PH

Description: Binixo Philippines - just an international online free broker which helps to choose the loan service you need, in order for customer could apply for the online loans as quick as possible

Summary About Binixo PH Loan Broker

Between lenders & customers in any market in the World exists brokers. There are several reasons why they are present:

- They strive to provide additional service and value for customers that lenders can´t do or just don´t want to do;

- They want to earn money by providing customers with recommendations;

- Some of brokers can take money for one´s services, but Binixo doesn´t do it, so you could just read the information and decide for yourself, was it good or not, apply loan with the recommended lender or not; all decisions are up to you.

ask ko lng if na approve po ba yong loan ko at saan po ba makukuhayong loan ko nag email kasi sakin ang binixo