Top loan apps in the Philippines are transforming the way Filipinos access financial services. With the growing number of mobile users, these apps offer convenience and speed, making them an ideal choice for those seeking quick financial solutions. Most loan apps are available for Android, but iOS options are steadily increasing. Additionally, Huawei’s AppGallery now hosts several applications to cater to its growing user base.

However, it is worth noting that some loan apps, though still available online, belong to lenders that have ceased operations. While these apps might appear functional, borrowers should exercise caution, as inactive lenders might not provide the promised services or may have outdated terms. Always verify the legitimacy and operational status of a lender before proceeding with any loan application. This review highlights the best loan apps and lenders in the Philippines for 2025.

Digido Philippines - 0% interest rate for the 1st time loan up to PHP 25.000, if borrower pay back in due time. Apply loan online with Digido and solve your urgent financial issue right now. If you need cash loan in a 15 minutes, Digido is the right solution.

CashXpress Philippines (CXPH) - apply loan online and get you money on bank account in 10 - 15 minutes.

Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

Finbro Philippines is a reliable micro finance company that can solve urgent financial issues in 15 minutes for people all over the country. Apply for the 1st loan up to PHP 15.000

OLP or Online Loan Pilipinas - apply your online loan 24/7. Your loan can be for any purpose, just read terms before, and, if everything ok, get your money with the help of microloan company.

UnaCash is the the financial loan product for Filipinos. It allows to get the loan online up to PHP 30000. You can get your money up to 24 hour online or quicker.

Moneycat Philippines is the online lender which provides fast salary loans for Filipinos. First loan with the 0,01% interest rate. For repeated loan is up to 11,90% per month. You can apply a loan online where never you are.

- Online loans in the Philippines have gained top popularity, allowing borrowers to apply for financial assistance with just a few clicks via smartphone apps. Whether you use the App Store, Google Play, or Huawei’s AppGallery, there are countless applications available to help you secure payday or salary loans quickly;

- Trust is crucial when selecting a credit service. Unfortunately, the market includes scam projects that misuse personal information, making it vital to choose a legitimate and reliable lender;

- Equally important are the terms of these loans. While online salary loans may not offer the same reliability as traditional bank loans, they have far fewer requirements, enabling faster and easier approval. The key is to carefully review the conditions and ensure they align with your financial situation;

- Below is a list of trusted loan apps in the Philippines, where your personal data will be protected, and the terms are clear and transparent.

Loan apps can provide a short-term solution to financial challenges. While they won’t resolve all financial issues, they can offer immediate relief in urgent situations. However, it’s essential to apply for a loan only when you fully understand the terms and have a clear plan for repayment before the due date. If you’re unsure about your ability to repay on time, it’s better to avoid borrowing altogether.

If you’re considering applying for an instant loan in the Philippines through trusted apps, here’s what you need to know to make an informed decision!

Table of Contents

The Best Active Online Loan Apps Philippines

So, if you need a peso loan online, check, please the next list of lenders. Of cause, applying online loan isn’t the best financial solution, but if you haven’t a credit card and you need money asap salary loan can help in an urgent minute. You can choose any app you’d like, but these are the most popular and interesting with their terms for Filipinos.

Digido Philippines Mobile Apps

Digido loan service is one of the most popular lenders in the Philippines. Digido Apps are convenient and focused to provide loans to Filipinos instantly. You can apply for the 1st time up to PHP 10.000, and further up to PHP 25.000

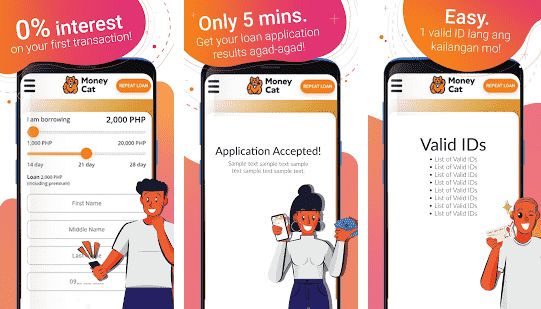

Moneycat Credit Apps Philippines

Moneycat Philippines provides loans online fast, and easily, with a 0,01% interest rate for the 1st loan. So, if you are 20 – 60 years old, the Moneycat PH app can support your financial activities and give you the salary loan you need.

| Loan Amount | up to PHP 25000 |

| Period | 90 – 180 days |

| Interest rate | 0,01 – 1,50% per day |

| SEC # | Certificate of Authority No. | CS201953073 | 1254 |

Moneycat Philippines mobile application is enough popular among Filipinos. The review score in Google Play is 4,5 among more than 2,5k users’ ratings. You can try it if you need, but obviously, check all the terms the loan service asks for.

Online Loan Pilipinas Apps Download Now

If you are looking for instant personal loan apps, Online Loan Pilipinas can help you with it. A very popular lender in the Philippines provides really quick salary loans for people 20+. It is a legal lender, registered with SEC, and has all financial licenses to provide unsecured loans online. OLP credit apps are really cool, quick, and with super usability. Terms are transparent, so just download the app and apply for the cash loan online you are looking for.

HomeCredit Philippines Apps Download Now

HomeCredit Loan Apps are very cool and for sure you need to pay attention to one. This lender is very popular among Filipinos. You need for sure to download one app and check all lender´s opportunities. Home Credit is a legal company in the Philippines, so be sure all your data will be safe.

Cashalo iOS and Android Apps

Cashalo suppose is one of the most famous loan companies in the Philippines. Great service and terms. This app is really for Filipinos. The brand is constantly developing, so it is very competitive among other lenders. Cashalo is operated by Oriente Group. One has a great app that can help in times of great need. If you need money asap, Cashalo will help you at once. Cash or Cashalo means to have a partner for your finances. You can get money as a salary loan or an installment loan if you want to buy something in Lazada or other stores.

| Loan Amount (Cashaloan) | up to PHP 10000 |

| Shop Now & Pay Later | max APR 49,68% |

| Period | 90 – 180 days |

| Down payment | 20% |

| Service fee | 10% |

| Interest rate | 5,99% |

| SEC # | Certificate of Authority No. | CSC201800209 | 1162 |

Cashalo has a 4,4 average score in Google Play among over 128k votes. No one among the top apps has not such a cool score. For sure Cashalo matters when Filipinos need money for urgent things.

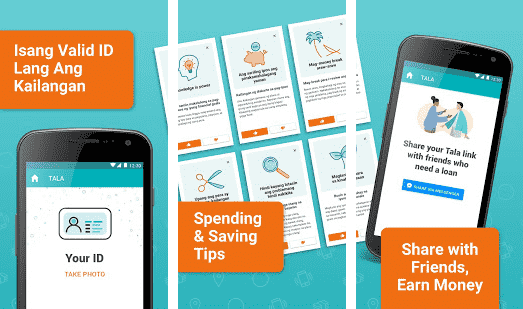

Tala Philippines Mobile Applications

Tala PH – it is a lender that has mobile applications. With a help of this, you can apply for a loan in 15 minutes. Money will be credited to your e-wallet or bank account. Tala Apps help manage your loan story 24/7. To apply for a loan with Tala application you need 1 major ID, so the company could identify the client. It is a very secure and reliable loan application in the Philippines. Very user-friendly and with competitive terms for appliers.

| Loan Amount | PHP 1000 – PHP 15000 |

| Period | up to 120 days |

| Service fee | 11% – 17% depending on the period and sum |

| Interest rate | 12% – 18% per month |

| Late fee | 8% |

| SEC # | Certificate of Authority | CS201710582 | 1132 |

Atome Philippines Apps Buy Now Pay Later

Atome Philippines – it is a BNPL service that helps Filipinos to get what they need with installments. Download the Android or iOS app, and get all opportunities of one right now. Also, you can empower your shopping. Atome has all top stores as its partner, so the app is really popular in the Philippines.

Juanhand Mobile Applications

JuanHand is the well-known lender and one has credit apps in the Philippines. It is the brand of WeFund Lending Corporation – a Chinese company with great experience and opportunities in Asia Fintech. Try the JuanHand loan app, it is really interesting and has enough good terms among lenders. If you need asap money and have no option to get one, JuanHand can help you with it but don’t forget to read the terms before, so you were sure you’ll be able to repay the money in time.

Non-Active Online Loan Apps Philippines

As we reminded in early beginning of this article, part of lenders are not active, but apps or ads of these apps could be online. So, just for your information that these apps are not recommended, cause their companies websites are not working, their apps also could be already banned. So, please always check information! Be aware of it!

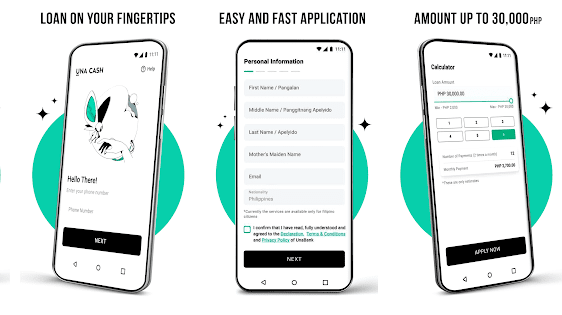

UnaCash Mobile Loan Application

- Unacash app is the brand of Digido Finance Corp. With the help of this app, you could apply for an instalment loan of up to PHP 30.000 for 6 months. This company also has the Robocash brand which was rebranded to Digido Philippines and Unapay – buy now, pay later service.

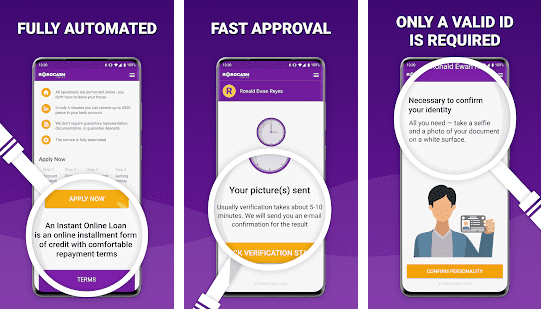

Robocash Mobile Applications

- Well, what to say, Robocash brand was changed to Digido Philippines and the brand has its mobile application on Android and iOS. The 1st loan is with a 0% interest rate if the borrower will repay the loan in time according to the contract. Very good for new customers, but if you cannot apply for a loan at all and solve the situation in a better way, do it;

- You could apply for a loan up to PHP 25000. The interest rate was 0,01% per day. Period: 90 – 180 days and SEC # | Certificate of Authority No. = CS201730459 | 1150;

- So, the Robocash brand was enough interesting for many borrowers, but now you can´t use it, only Digido Apps.

Pera247 Apps – What You Need To Know About It

One more loan app with the help of which you could apply for a cash advance. Not many requirements, a user-friendly app with its own opportunities for lenders. Pera247 was good app, but not for a long time. App is not active, so we recommend to choose another lender.

Banned or Illegal Loan Apps in the Philippines

Many loan mobile applications were already banned by SEC. Some of them were scam projects, some not. For sure not all scam projects were closed, so be aware of it and choose only legal and popular services with history and trust among Filipinos. Choose your online credit apps in the Philippines and solve your financial problems quickly and with the terms you need.

Cashwagon Philippines Apps

Some time ago, Cashwagon Philippines was very popular, but then, for some reason SEC banned it and now lender doesn´t provide loans. So, better to choose another lender for getting money online.

You can read more about illegal loan companies here. Be careful, and apply for a loan only in reliable lenders. There are many loan apps, that are not registered in SEC, so be very attentive.

How to Apply for a Loan Using Mobile Apps

Usually, loan mobile applications have high usability: intuitive interface, nice design, and good terms. For sure, such apps should be without annoying ads. Credit apps in the Philippines should have a positive rating in Google Play or App Store. Apps must be quick and they shouldn’t work slowly on your smartphone. Of cause, it must be updated in a constant way by developers. Apps are free, you pay only for the interest rate, and depending on the lender´s terms, they can have additional fees.

So, how to apply for a quick online loan with the apps:

- Decide if you really need a loan – there are many situations when you need money from one side and don’t need it from another one. If it is not an urgent need, don’t apply for an online loan with the app, and vice versa;

- Sum and terms of the loan – if you decide to apply for a loan, you need to understand what amount of money you need now, and choose the loan application; when you will select the app, obviously read the terms and requirements before applying the one, so you were sure you understand all terms;

- Registration process – when you have already opened the app. The next step you need to do is go through the registration process. For this, you need to pass out the application form and create your personal account. The main requirement for it is providing your major ID, photo, and other personal information;

- Apply for the cash loan online and get your money – after the registration process, the customer needs to agree with the terms and apply for the loan; the scoring system of the lender will do one job, and, if everything ok you will get your money on the bank account, card, or on your e-wallet;

- Repay your loan in time with your loan app – many people forget that if you get the money you need to repay the loan in time. It is very important to do, so borrowers could avoid late fees and other problems connected with credit score worseness, lenders can sue the debtor, etc.

Why Choose Loan Apps in the Philippines

Loan apps have become a popular choice among Filipinos for their accessibility and ease of use. Here are the main reasons to consider these apps:

Advantages of Loan Apps

- Fast processing: applications are approved within minutes, with funds disbursed on the same day;

- Minimal documentation: most apps only require a valid ID and a few personal details;

- Secure transactions: reputable loan apps ensure your data is encrypted and protected;

- No collateral needed: unlike traditional bank loans, no assets are required;

- Flexible repayment options: apps often provide various methods for repayment, such as bank transfers, e-wallets, or over-the-counter payments.

Disadvantages of Loan Apps

- Privacy concerns: some apps access personal data and contacts, which may lead to misuse;

- High-interest rates: loans can be costly, especially for repeat borrowers.

- Additional fees: some apps include hidden charges, so it’s essential to read the terms carefully.

- Scams: not all loan apps are registered with the SEC, increasing the risk of fraud.

The Most Common Questions About Best Instant Loan Apps

⭐ Are Loan Apps Safe in the Philippines?

The 1st that is very important, lenders must be registered with the SEC and have a Certificate of Authority. The full list is not big, so you can check it quickly and easily.

The 2nd point will be about the brand of the credit company. If you hadn´t about it before nothing, people you know also never had about such a company, suppose better to avoid such company. So, popularity, reviews, and ratings are very important. You should know what other people say about the exact lender from where you want to get the loan.

The 3d point – check the terms, compare one with other lenders, and choose those which are ok for you.

So, at least, these 3 recommendations will help you to avoid some loan companies and make loan applications safe for you. You can also pay attention to usability, the website, history, if the lender has a team and it is present on the website, Linkedin, etc.

⭐ What Are The Top Legit Loan Apps 2025 in the Philippines Are Worse For Your Attention?

Try the following loan mobile apps from the next lenders: Digido, Online Loan Pilipinas, Tala, Moneycat, and Finbro. It is difficult to tell what mobile app is the best, but the most popular suppose Tala apps.

✋ Why Online Loans With Apps Can Be Dangerous?

Quick loans can be dangerous for every Filipino. When borrowers apply for online loans with the apps, he/she must understand the responsibility. Very important to read all terms, so you were aware of all moments. Before applying you should understand how you will repay it and if it is possible to do it in time.

If everything ok here and the reason for taking the loan matters, then you can do it, but if: your reason is poor, you don’t know when and how you will be able to repay it, you are lazy to read the terms, etc…, PLEASE, DON’T APPLY FOR ANY LOAN. NO MATTER IF IT IS FROM A LOAN SERVICE OR BANK.

> If You Have iOS, Where You Can Apply For a Loan Online?

iPhone loan apps are also very popular. Almost all services already have their mobile apps in App Store, so don’t worry about it, just choose the service you’d like.

Also, if even one service will not have an iOS mobile app, you can apply for a loan online with the website, for example, Digido, Finbro, Moneycat, OLP, PesoRedee, Tala, Cashalo, JuanHand, etc., that can help you with it.

More About Loan Apps In the Philippines

Name: Best Apps in the Philippines

Description: Loan Apps Philippines - lenders launch own mobile apps in the Philippines and here we prepared for you review of the best ones. Terms, requirements, interest rates, reviews, contacts, etc.

Summary

The main advantages and disadvantages of peso loan apps Philippines are:

Pros

- fast installation process;

- you can get the money in 1 day or several hours, and sometimes even quicker;

- all personal information is secured by lenders;

- no paperwork and this is cool;

- in most cases your location isn’t important, the main point you were from the Philippines and in the Philippines

- many different options to repay a loan;

- it is very convenient;

- the information about your loan is always with you;

- some of the apps have 0,01% interest day for the 1st loan.

Cons

- high-interest rates;

- additional fees;

- sometimes not transparent terms;

- no, all apps have SEC registration, so they are scam projects which are interested to gather your personal information and use it to earn;

- if you will not pay on time it can create a lot of real problems for borrowers, etc;

- apps have access to your personal information and contacts (some less, some more).