Digido Philippines - 0% interest rate for the 1st time loan up to PHP 25.000, if borrower pay back in due time. Apply loan online with Digido and solve your urgent financial issue right now. If you need cash loan in a 15 minutes, Digido is the right solution.

CashXpress Philippines (CXPH) - apply loan online and get you money on bank account in 10 - 15 minutes.

Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

Finbro Philippines is a reliable micro finance company that can solve urgent financial issues in 15 minutes for people all over the country. Apply for the 1st loan up to PHP 15.000

OLP or Online Loan Pilipinas - apply your online loan 24/7. Your loan can be for any purpose, just read terms before, and, if everything ok, get your money with the help of microloan company.

Kviku is the international lender that support online loans in the Philippines. The number of service customers constantly growing. Kviku provides installment loans for Filipinos. Want to know mode details? Follow the AdvanceLoans.ph article and find out more about this finance service: how to register, what are the terms, reviews, requirements, etc.

Moneycat Philippines is the online lender which provides fast salary loans for Filipinos. First loan with the 0,01% interest rate. For repeated loan is up to 11,90% per month. You can apply a loan online where never you are.

Crezu Philippines - it is online broker with the list of loan partners who can provide customer with the loan

Binixo Philippines - is an online broker that doesn´t provide online loans, one only recommends the lender you could be interested in. Binixo PH is not responsible for your decisions, the broker only provides about lenders in the Philippines, so when you choose one, please read all terms and responsibilities on the lender´s website/app.

Pitacash app - one more alternative way to get quick cash loan online in the Philppines. Try the 1st loan with 0% interest rate and find all service opportunities. Best Review 2023

Nowadays online loans have become popular in the Philippines, addressing the urgent need for short-term funds among many individuals. While traditional bank services are an option for some, a significant portion of Filipinos face obstacles due to factors like poor credit scores or lack of banking access. In fact, only about 2 out of every 10 families in the Philippines have savings in banks, highlighting the prevalent issue of financial exclusion, so still many Filipinos are unbanked and can´t use banking services.

Bank loans, although desirable, often come with stringent requirements that can be daunting for borrowers, especially when seeking smaller loan amounts. This has led many Filipinos to explore alternative financial services such as cash lenders or individual lenders, commonly referred to as ‘loan sharks.’ However, engaging with loan sharks poses significant risks and may lead to a deterioration in the financial condition of the borrower.

Fortunately, there’s a safer and more convenient option: legal loans online in the Philippines. These loan platforms provide accessible and transparent borrowing solutions without the need for traditional banks or risky lenders. By opting for online loans, borrowers can navigate their financial needs confidently while avoiding the pitfalls associated with informal lending channels. Of cause, many can use bank services and get money from one, but there are many Filipinos who can’t do it cause of bad credit scores or other reasons. This is the main reason why many people practice other finance services: cash lenders or individual lenders (called “loan sharks”). The last one is a very risky option.

Borrowers should know, that they can apply for a legal credit online without using banks or “loan sharks” services.

Loans in the Philippines

Table of Contents

Online loans in the Philippines become more accessible with the Internet. Today everyone can research any information he/she needs and apply for credit online if the person needs money asap. Lenders becoming more and more popular, but not always it is the way to solve your financial issues, cause the borrower should repay the money back in time, and this is not easy. So, you can get a cash credit online, but be careful of scam lenders and stay away from them.

- Of cause, credits from family

are the best option to borrow money and no documents are needed, but relatives often forget to repay the money, and this influences the relationships very much in a negative way; - Also, there is one more good option to get a credit – from community cooperatives. For example, in villages, there are cooperatives that provide small micro-loans for people with different needs;

- The 3d option is using the services of online lending companies.

TOP Lending Services in the Philippines

Quick credits are for asap situations: you need to give money back or buy something important.

You can divide personal loans in the Philippines on secure (require collateral) and unsecured (without collateral).

How to Choose Online Loan Services

Online credit is a serious matter that requires attention. You can apply for microloans anywhere online. It should be a balanced decision, not a momentary one when you need just to get money.

If you decide to apply for microloans in the Philippines online, then it should be from a reliable financial company. Also, remember that if you are late, even the most reliable and kind-looking microcredit financial institution can make your life worse at times. Therefore, there is a choice of lesser evils, but if there is an opportunity to use a credit card, then use it and do not get into microcredits.

You can easily find a credit company online. The main thing is that these are really accredited companies, registered by SEC. Also, you should understand that it is quite difficult to find a suitable credit company, so it is important to consider the following criteria when searching:

- The company must be legal;

- The conditions should be interesting and feasible for you: interest rates, payment options, terms, late fees, other fees, etc;

- The speed of obtaining a credit online is no more than 1 day or even 1 hour, cause you need money asap;

- Easy to apply online for credit – it is also important;

- Penalties are acceptable: you must understand them and always check this option (final version in the contract) in order to accurately understand the consequences of delay;

- Company reviews are also important to other people.

This will be enough, so you could quickly decide in favor of a particular lender. So, please take note of this information, cause that’s why payday loans are not an easy thing.

How to Know If The Lender Is Reliable and Legal

How to know if the lender you are applying to is legal? It is important to understand, but it is not always clear what you need to pay attention to in order to see what’s what. Moreover, there are a lot of fraudsters in the market, but there are several things by which you can determine the legality of a credit company:

1) Must be certified by SEC

All credit companies that legally want to work must register with the Securities and Exchange Commission (SEC). This registration is an acknowledgment by the authorities that the business is eligible to operate in the market;

2) The official website of the lender must have full contact information with a real physical address

This is important because if questions arise, something needs to be agreed upon, working contact with the credit company is needed, and if there is no such thing, then this puts the lender in doubt. And questions can be different: from clarifications on the contract to credit repayment. Who wants to apply for a credit online, if it is impossible to contact a credit office? The physical address is also important, as it is another confirmation that the company really exists.

3) Transparent conditions for borrowers

The advertiser is interested in the landowners’ attitude to loans responsibly. Then the risks will be lower, and this leads to better conditions for interest rates. Do not forget, you do not need to apply for loans online if you have not figured out all conditions.

4) No prepayments

Lenders that operate legally do not require any prepayments, there is no such thing, so please do not be fooled by this. Lenders work only in the format when they issue online loans in the PH, and then charge interest for the days of using the credit.

5) When registering, only basic information is asked

If filling out the online questionnaire, you see something suspicious. For example, if there are a lot of information fields and strange questions, then this is already a signal that something may be wrong and it would be better to double-check the credit company in all parameters before applying for a credit in it.

AdvanceLoans provides up-to-date information on credit services in the PH. But, all the same, do not forget to double-check the information and, especially, re-read the agreement of the lender! And better several times! Be careful, learn from the mistakes of others, and do not get fooled by advertising and interest-free loans, although some offices issue loans in the PH on almost such terms at 0.01% per day, which is also not bad.

How Everything Works

To take a quick credit in the PH you need to enter into an agreement with the lender. For this, you need to choose the credit company, amount, and loan period, read all terms, in order, understand all rules and, if everything ok, agree = and promise to repay the money according to the exact terms in the contract. If the borrower will do it in time, he/she will pay only the commission for the day’s loan was used. If the borrower will not do it in time, the lender can add a fine and increase the commission, so in total borrower:

- will need to repay much more money;

- credit score will be spoiled.

Here we talk more about unsecured loans, where interest rate

Of cause, better use bank personal loans, but not all can effort it, so then you need understand all responsibility of taking such unsecured loans!depends on the service can be 0,01% – 3,00% per day depending on the service.

To repay money people usually use their credit cards, cause it is faster and easier for borrowers can do it with the bank service.

How Much Can You Borrow

Reply to this question you need to understand how much you need. For what goals does he/she want to take the money? How much can you repay and in what period? Where borrower will take money when a deadline to repay will come? Does the borrower have other options to get money, what will be the best one?

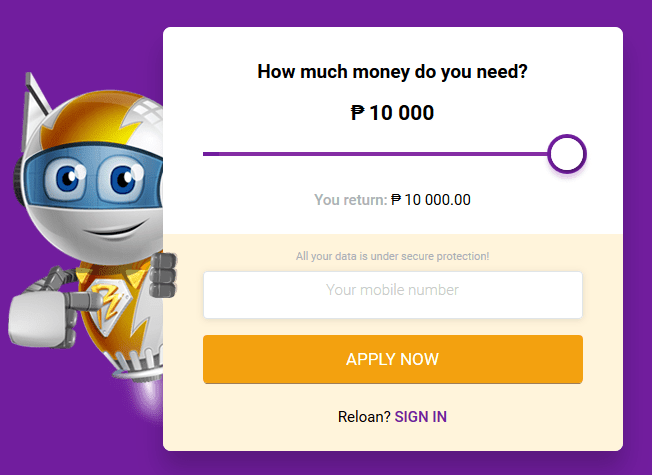

For example, for instant cash loans, the PH Robocash (now Digido) service offers one of the best options: up to PHP 25,000 for the period of 3/4/5/6 months! 1st loan is only for PHP 10,000 but the interest rate is near 0,01%!

Should You Get a Personal Loan

There are many different types of loans in the Philippines, but personal loans cover your asap needs. It can have low and high-interest rates and mainly doesn’t require any collateral, but it doesn’t mean you should apply for the credit, you need to know when it is normal and when is not:

| To consolidate the debt | To pay off credit card debt |

| To refinance the other credit | For some asap expenses |

| Some home improvements | To pay medical costs |

| For the education | To improve the credit score |

Don’t forget to:

- Check if your credit score is good;

- Compare the terms of all lenders.

6 Key Reasons Why People Apply for a Microloan

Cash loans online are created in order to give people of different social statuses certain financial assistance. Of course, all of us can spend the cash from lenders on absolutely various things (if not to take into account the cases when the lender provides you with particular parameters concerning the money you get), it may seem unreasonable, but still possible. In case you plan to borrow some money, the best recommendation is to keep to the right reasons, for instance, those below.

Studying and Education

Want to get cash credit for studying – you are on the right way, as this very reason is really solid. When we devote time and endeavor to academic studies and life, we receive a very strong starting experience and certain knowledge that will help us to be ready for any difficulties, which appear our way, making us have other ideas for changing this world. Now you see that by contributing your loan proceeds to studying and educational background, you lay the foundation for your personal future

Home Renovation

One more good reason to spend loan proceeds is to improve your home. In some time we often start to notice that our home requires something new and better to make our life more convenient and comfortable. Efficient solutions for renovation will definitely help you to find what you need. Moreover, while making these improvements we simultaneously grow our property’s value, which will help to offer a higher price in the process of selling your house or flat and receive great deals if to apply for collateral loans.

Consolidation of Debt

If you have a credit you can not repay for some reason for so long, or even have several of them, you can simply use the money to forget about them and shorten your loans just to one. Sometimes it happens that paying back a debt can be not so easy, especially in those cases when it is necessary to pay for two or three loans per month. Due to debt consolidation, you can address all the matters connected with your dues very fast including the opportunity to control your finances productively.

New Business Opportunities

People who strive to start their own businesses but need some more financial assistance are extremely recommended to get loans for this very purpose. Despite the fact that many people consider taking on debt a bit insecure for those who own businesses, at the same time loans can bring a very good benefit for your enterprise in a number of ways. For instance, credit money can improve our business making some palpable changes in terms of operations and bringing an obvious effect on profitability.

Urgent Necessity

In some unpredictable situations or even better to say emergency cases you may need some assistance very quickly, that is why here you can use credit money. Financial troubles occur and we cope with them promptly due to emergency loans. This kind of financial help really works and gives you the means to settle any difficulties that appear your way unexpectedly.

Be Responsible for What You Borrow

Almost everyone can take out a cash loan, but in real life, it is not usually reasonable and necessary to do. Think about responsibility, if you get this money and use them properly for something important, cash loans very often better your plans and strategies in terms of finances and, at the same time, improve your life considerably. So, it is important to weigh the pros and cons first.

Questions About Loans in the Philippines

✅ How To Apply For A Personal Loan In The Philippines In 2024?

Personal or unsecured loans are very popular already several years. Everyone 18+ years can apply for one with the help of:

website – applying with the online application, for example, Moneycat, Robocash,

mobile application – from such lenders as Tala, Cashalo, OLP, etc.

✅ Who Can Apply for Loans Online?

Mainly people who reach 20+ years of age. Only the citizens of the Philippines.

✅ What Are The Best Lenders 2024?

The best lenders are Digido, OLP, Moneycat, Finbro, Tala, etc;

✅ What Filipinos Should Know About Online Loans PH?

The main point is, that every borrower should understand before applying for the loan how he/she will repay it. Also, you need to understand if a credit is really needed for you, perhaps you could avoid applying one.

Remember: you spend other people’s money, but will give back yours!

Advance Loans In The Philippines

Name: Loans Online In The PH

Description: AdvanceLoans - credit comparison website in the Philippines. Interesting blog about Fintech. Apply for your online loan now!

Summary

If you want to know more about Loans in the Philippines, Sri Lanka, etc., you should know in detail the terms of each loan service. Also, you need to understand the advantages and disadvantages of lenders.

Pros

- quick loans online – it is one of the fastest ways to get money for a short period of time

- no need a lot of documents

- everything online, but you can get money also in the centres

Cons

- enough risky to be late with repayment and get into the financial troubles

- high interest-rates

- not always transparent terms

- a lot of scams

- your credit score can be spoiled

Loans

If you want to know more about loans and borrowings in the Philippines, then you have a direct road to AdvanceLoans. The site contains a huge amount of information for borrowers, all the leading of the region are presented, there is comparative analytics and a lot of useful information, on the site, you can apply for a loan online without leaving your home.

Did you find this review helpful? Yes No

Credit

Before that, I took out loans at very high interest rates and could hardly repay them. Thanks to your articles, I found a bunch of organizations in the Philippines and, finally, I get loans online without any problems without contacting the bank. You can pay for them using a regular app. Previously, in order to repay the loan, I had to go to the bank, which annoyed me very much and plus I spent a lot of money on the way there and back.

Did you find this review helpful? Yes No

Top

I studied in the Philippines and worked as a courier in a small clothing store. And I didn’t have enough money for a bike, I read an article on your website about loans and found organizations that issue them with small commissions. I really really like it. I took the bike on credit and am happy. I am steadily paying off my loan, and I am doing well. I’m glad I found your website and I can find loans.

Did you find this review helpful? Yes No

Like

I was in the Philippines and I needed a micro-loan, they told me on this site how to get it without contacting a bank, I was able to find an organization without any problems that could help me with finding a loan, I’m really glad that I was able to find a website that sends loans. The main thing is to repay the debt on time, then there will be no problems. Personally, I like everything, you are the best, thank you so much for such a wonderful website with articles about loans.

Did you find this review helpful? Yes No

Very good

I love that advanceloans.ph site in Sri Lanka has so many articles about credit and loans. Thanks to you, I was able to find a loan with a small interest and buy myself an inexpensive car. I used to take loans, but now I realized that it’s not scary, it’s just that the main thing is to pay on time, then everything will be in order! I took out a loan on a site that the site advised me and I pay off the loan, I like that the money I borrowed was credited immediately and it’s really cool.

Did you find this review helpful? Yes No

Like

I like that there is such an extensive catalog of articles about loans in the Philippines, which I just needed. I really like it. Every day I read your articles, and I really like them. Loans are really a problem in the Philippines, too few people know about them. It’s good that there is your website, which is pleasant to read and convenient to use! Thank you for taking out loans thanks to you.

Did you find this review helpful? Yes No

Great service

I like your article. Indeed, in the Philippines, people don’t know much about banks and what they lend to people. I live in the village, and thanks to your article I was able to borrow for the first time. I like that they give out money immediately, and the interest on the payment is small. In general, I didn’t know anything about loans before, but thanks to your articles, I know everything.

Did you find this review helpful? Yes No

Very good

When I was a student in the Philippines, I worked, but I couldn’t save money for my dream, it was a scooter. Thanks to you, I was able to find a low-interest loan and purchase it, and I am very grateful for that. I was really happy when I found out that I had been given money. Now I am paying the loan, but I have a scooter on which I had to go to my university at high speed. I will read your articles more often.

Did you find this review helpful? Yes No

Real super

Excellent collection of credit institutions in the Philippines. We have very few people in the Philippines who know about loans, unfortunately, I don’t really like it, and it’s sad. Therefore, my friends need to know about this wonderful site in order to become financially literate, I think so, of course. I think the Philippines needs to teach people what loans are and how they work.

Did you find this review helpful? Yes No

Super.

I like that here you can really read a bunch of articles about loans in the Philippines. I like that here you can really find an organization that can help you take out a loan in the Philippines. I tried to look for organizations myself, but, unfortunately, nothing came of it, and I didn’t like it. Thanks to your website, I can now not worry about money, I can get money from any organization absolutely without problems, thank you.

Did you find this review helpful? Yes No

Very nice

I read your articles like news, we have a very poorly developed credit system in the Philippines, and few people know about loans. I recommend everyone to come in, you will definitely like it as much as I read articles here. My friends also use the site, and we learn more about loans every day, and this makes me very happy. Thank you for the opportunity to make life better.

Did you find this review helpful? Yes No

Best

I like that this website dedicated to loans in the Philippines is really very simple and convenient, I can learn about loans and micro-loans without any problems. So I recommend everyone to go for it, it’s really worth it. My friends love loans and learn about them. We like that the percentages here are small for many organizations. I think you are the best in terms of writing articles about loans!

Did you find this review helpful? Yes No

Very super good

I like that you can really find a credit institution here without any problems and take a loan from them without any problems, so I recommend it. The best credit organizations of the Philippines are really collected here, which is very rare. I am glad that there are you and your excellent articles on such a topic. In the Philippines, it is really difficult to find an organization that deals with loans.

Did you find this review helpful? Yes No

Very super good

I took out a loan at robocash, and I like to borrow there. I was able to buy a motorcycle and fix it with credit money. Therefore, I recommend everyone to take a closer look at their wonderful website, here you can take out a loan without any problems. The organization works wonderfully. I read your articles daily and I like what they write here about loans in the Philippines.

Did you find this review helpful? Yes No

Super good

I am glad that I can read articles about loans and soft loans in the Philippines and Sri Lanka on your website. In general, I would like you to continue to develop the topic of loans in the Philippines. We really have very little information on this topic, but I am telling you the truth that you are the best in your field. We read your articles with the whole family, and we like it.

Did you find this review helpful? Yes No