Crezu Philippines - it is online broker with the list of loan partners who can provide customer with the loan

- Age 20+

- Documents Major ID

- Citizenship only Filipinos

- It helps compare the loans

- you can apply online

- Not much information about the service

- It works like that: you register in the Crezu, that choose the loan service you like, and ater you applying the loan on the website of the lender - too much steps

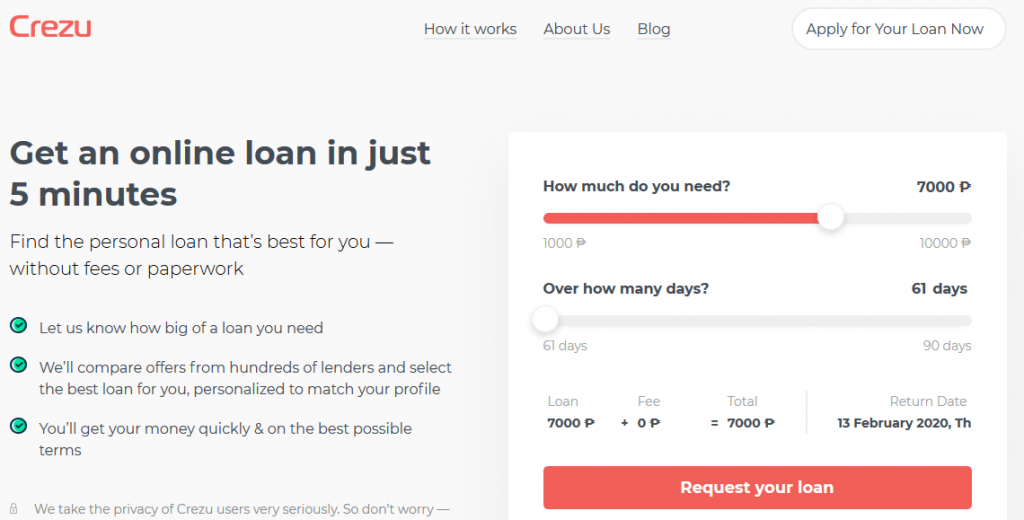

Crezu Philippines – it is an international online loan broker. With the help of one, you can apply to the different loan services. So, with Crezu borrower can find the best personal unsecured loan in the Philippines. Company is enough new on the market, but as it has international experience, suppose, they will be improving their service very quickly.

Just give broker to know more about:

- how much money do you need;

- then Crezu compares lenders and gives you the best offers from lenders in PH (for example: Robocash, Moneycat, etc; also lower you can check those lenders)

- then quick apply and, if everything ok, money in 24 hours or quicker will be in your pocket or card.

Table of Contents

Crezu Philippines

Crezu is the comparison website, service cooperate with different lenders which have different terms, but in general, they are next:

| Loan period: | 1-2 months or more |

| Interest rates, APR: | 12% – 144% |

| Time for applying for the loan: | 10 – 15 minutes |

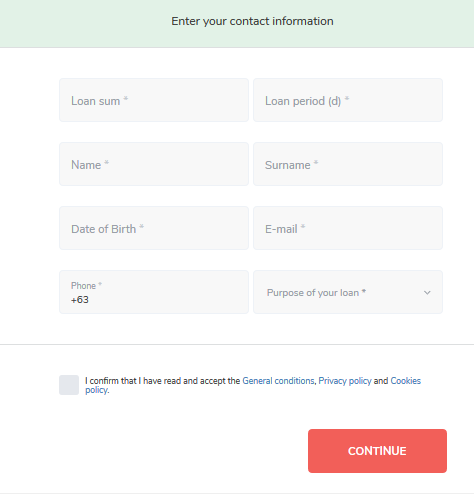

So, how to get Crezu loan in the Philippines:

- Fill in the application form – just 5 minutes, only your ID is needed

- Get the best loan offers – choose which match with your need best of all and apply one if terms are ok

- Get your money online or with cash, depending the loan service in the Philippines

Crezu Advantages

- All data is secured;

- Crezu doesn’t charge any service fee;

- One place for many lenders in the Philippines;

- Service works 24/7, just find the loan you need;

As service works online, it made easier for Filipinos to find the loan they need and apply one with the Internet. Usually, it is not a good idea to use unsecured loans in the Philippines, cause it is great responsibility and borrower must repay in time if he/she doesn’t want to lose more money, credit score and get into big problems. But, sometimes lenders can solve quickly finance situation when you can’t get money.

Example of Loan Lenders

This is an example about the list of loan companies on Crezu. In general, you can register there, so service send you notifications, some updates, etc. But here is the list of top active loan companies in the Philippines, and one will be continue to grow, so you can return this page, our website or again, register in the loan broker service.

Digido Philippines - 0% interest rate for the 1st time loan up to PHP 25.000, if borrower pay back in due time. Apply loan online with Digido and solve your urgent financial issue right now. If you need cash loan in a 15 minutes, Digido is the right solution.

CashXpress Philippines (CXPH) - apply loan online and get you money on bank account in 10 - 15 minutes.

Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

Finbro Philippines is a reliable micro finance company that can solve urgent financial issues in 15 minutes for people all over the country. Apply for the 1st loan up to PHP 15.000

OLP or Online Loan Pilipinas - apply your online loan 24/7. Your loan can be for any purpose, just read terms before, and, if everything ok, get your money with the help of microloan company.

Besides, if you were applying the online loan and some loan company rejected your application for some reasons, you can choose other loan company and try luck with one. Just check all terms with details, read online all info about company, and what you should expect, if you will no repay loan in time.

Crezu PH Contacts

If you have some bugs, what to find our some additional information, here is the contacts:

| Email: | clients[@]crezu.ph |

| Website: | https://crezu.ph |

| Main company: | Fininity Ltd, registration number: 14523902 |

Crezu Reviews

If you have already used Crezu Philippines service, please, write your feedback lower in the comments. It will be useful for other people, so they could understand more if one service is worth of your attention. Cause online, currently, we didn’t find any testimonials, so hope with time we’ll get one.

💳 Why You Should Use Crezu PH?

Because it is a free loan broker that doesn’t charge money. It has info about loan lenders and can help you to choose the best one;

⚡ How Do Crezu Philippines works?

It is loan comparison website, just fill in online application and get personal match from the Crezu; also, be ready that service will send you email newsletters and other notifications cnostantly;

⏳ If the Borrower Has a Bad Credit History, Can He/She Get the Loan?

Sure, Crezu will give you the best options to choose among services which potentially can give you loan; broker doesn’t provide loans, only shows what are the best for you or for them in order to learn;

💰 What is the Interest Rates?

Crezu service cooperates with different lenders, so it depends on exact loan originator and circumstances of the borrower; also, it will depend on the product you apply – payday loans have one terms with period up to 30 days, installment loans have other terms with period up to 3 – 12 months.

⭐ Is Crezu Legit?

Company is legit, but it is not registered in SEC, cause it is not a lender, it doesn’t provide loans; service only compare the information and shows you were you can get loan online.

Crezu Online Broker

Name: Crezu

Description: Crezu - is an international loan broker. Company strives to help people find the best loan solution. It compares different loans, showing those you could like or in general present on the market.

Summary

if you want to apply loan with the broker, you can do it, it is your right, but remember, before applying the loan quickly in some unknown service important to know more about one lender. For example: is it legit? is it reliable? what are the terms when you apply? and when you failed repay in time? are you ok with requirements? what people say about that service? what are the main competitors of one? (possibly those could have in some cases better terms, etc.). Be responsible before applying the loan. Understand, please all risks, and only than continue!