Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

With Tonik you can apply for a quick loan in 30 minutes and up to PHP 50.000. Everything is secured and no collateral is needed. So, you can apply for a quick loan, flex loan or shop installment loan with Tonik bank very easily.

Digital banks in the Philippines have a really innovative approach for their customers by providing the top financial products and services to one. These companies set new benchmarks in the financial industry and continue growing rapidly.

The rise of digital banks in the Philippines is the unique journey that has own coombination of different factors like pandemic period and great demand of Filipinos for the financial services. Traditional banking practices gave way to digital alternatives, the appeal of digital banks grew exponentially, cause people are really interested in mobile deposits, loans and other financial products that could be provided 24/7 with the mobile apps.

BSP or Bangko Sentral ng Pilipinas have played the main role in ensuring the safety and security of customers engaging in digital banking activities. Currently, in the Philippines we can see 6+ digital banks that have really cool products and are user-friendly for Filipinos. These digital banks transformed the way people can manage their finances within the palm of their hands.

Table of Contents

The Best Digital Banks in the Philippines 2023

- Tonik Digital Bank

- Maya Bank

- Overseas Filipino Bank (LandBank)

- UNObank

- GoTyme

- Union Digital Bank

Tonik Digital Bank Short Review

Tonik is the pioneer digital bank in the Philippines that has a license from the Bangko Sentral ng Pilipinas. Bank has operational hubs in the following cities: Manila, Chennai and Singapore.

Tonik provides for its customers different financial services: Filipinos cam open deposit accounts, get virtual credit card, using one app you can get access to ifferent loan products like quick loans, flex loans, big loans, and installment loans. Thanks to the bank’s unrivaled service, customer focus, and incredible mobile app functionality, Tonik is the best choice for Filipinos looking for efficient and customized lending solutions.

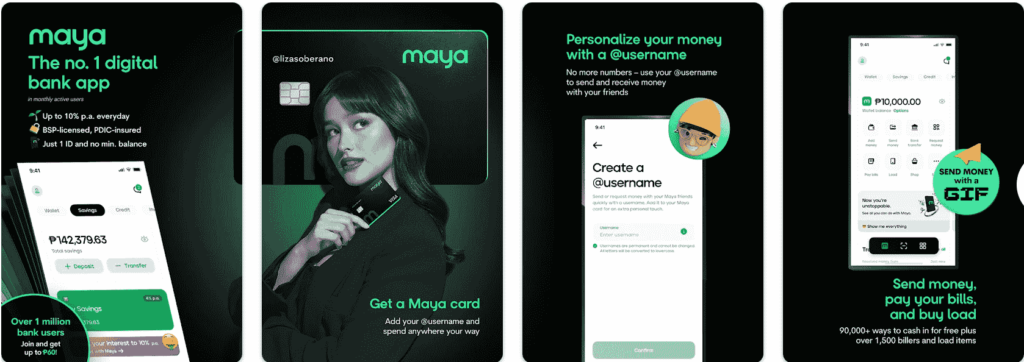

Maya Digital Bank

Maya Bank offers a range of features and services, including cashless payments, money transfers, deposits, loans, etc. All access to the bank products is provided with its mobile apps. Maya Bank is very popular among Filipinos for its ease of use and accessibility, allowing users to perform various financial transactions and manage their money digitally. For sure this is one of the best digital banks in the Philippines.

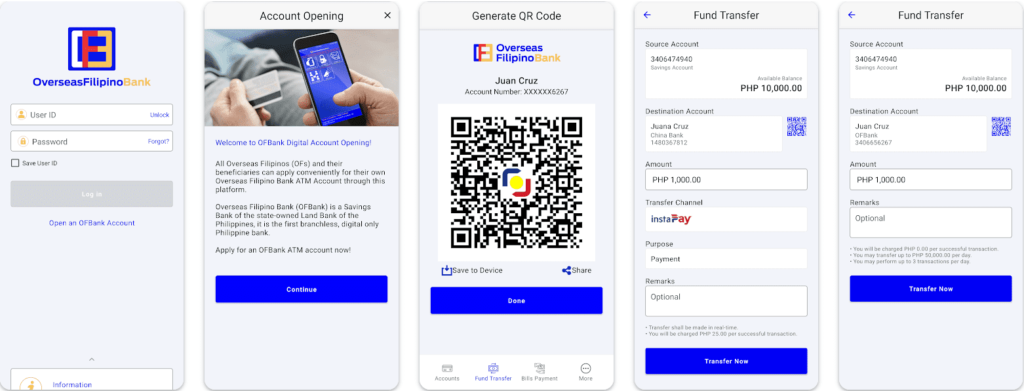

Overseas Filipino Digital Bank by LandBank

The Overseas Filipino Bank (OFB) is a fully-owned subsidiary of Land Bank Philippines. One of the bank’s primary objectives is to facilitate faster, more affordable, and convenient remittances from Filipinos abroad to the Philippines. This service has become indispensable for millions of OFWs worldwide.

The OFB digital bank offers a range of unique services, including a digital wallet, remittance and payments platform, e-commerce services, and access to various financial products such as savings accounts, debit cards, loans, investments, and insurance.

Additional information about Overseas Filipinos and Overseas Filipino Worker – they are the main target audience for Overses Filipino Digital Bank in the Philippines.

UNO Digital Bank

UNOBank offers a range of loan products to cater to the financial needs of Filipinos: personal loans, business loans, home loans, etc. UNObank is a digital bank with convenient online platform and strong focus on credit services. One was established in 2020, it is operated by DigibankASIA, a Singapore fintech company.

GoTyme Digital Bank

GoTyme stands as the sole digital bank in the Philippines to provide a physical VISA debit card within a remarkable 5-minute timeframe and at no cost, courtesy of its nationwide kiosks. Notably, it distinguishes itself as the only cloud-based company in this domain. It is secure, reliable and one for sure constantly improving the financial experiences of Filipinos.

Union Digital Bank Digital Bank

Union Digital Bank or UDB is the digital banking arm of UnionBank Philippines. It is for sure one of the six officially approved digital banks in the Philippines by the Bangko Sentral ng Pilipinas. UDB has the following top financial services as loans, debit cards, and credit cards that were recognized on Global Finance Awards, so it is for sure one of a leading innovator in mobile banking.