Cashme Philippines (Hupan Lending Technology Inc.) - apply for a quick loan online with Cashme. Several steps and you get your money online. Check the review about Cashme in the Philippines and how loan service works. You can download the app for your Android, iOS, or Huawei device. Feel free to get a quick unsecured loan online in the Philippines, but be ready before to repay the loan in time, in order you could avoid penalties and additional financial problems. Of cause, better not to apply for loans at all, but if you really need you can check Cashme or other loan services like Digido, Tala, Cashalo, Finbro, Cashxpress, Moneycat, etc.

- Loan amount PHP 2000 - PHP 12000

- Loan period from 91 - 180 days

- Interest rate 0,5% (APR 20%)

- Documents 1 major ID

- Age 18+ years

- Citizenship for Filipino only

- SEC company registration NO.CS201901197

- Certificate of authority NO.2879

Cashme Philippines review 2023. Each of us is familiar with the situation when money is needed for unforeseen expenses, for instance, to repair a laptop or to give a gift to friends, but there are no funds in the account. Often, a minimal amount is not enough, but it is not always possible to borrow it from relatives. You can always get money quickly and without references from Cashme PH.

- To borrow money from a bank, you need to find a guarantor and provide a certificate of employment and income certificate. The manager at the bank considers the application for a long time, and if your salary is minimal, there is a high chance that the loan will be refused. An online loan from the loan service will help you get money quickly.

- The lender offers a solution to those who need money quickly and easily. You need to upload your information and the amount required, provide a credit card number, and the funds will be transferred in just one business day. Cashme is committed to ensuring customer security by always keeping your information private.

Table of Contents

Apply for a Loan in the Cashme Philippines

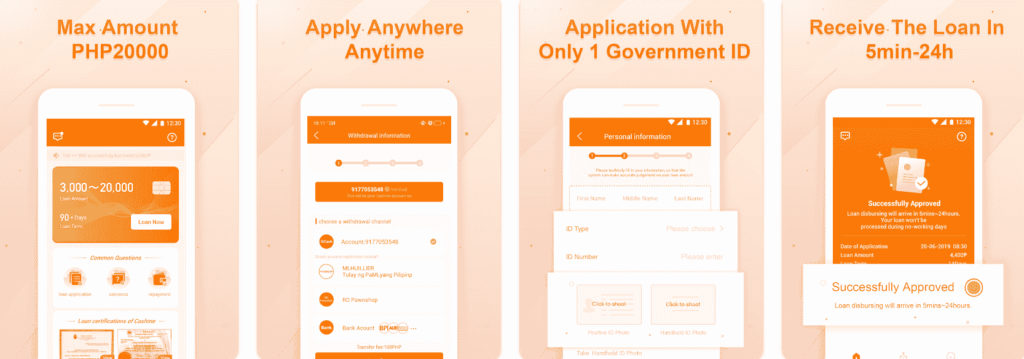

Cashme is a company that offers a quick and easy app to get loans. This new service is currently being offered on Google Play, App Store, and App Gallery:

- Visit the app market you need according to your phone device;

- Download Cashme via a search on your phone;

- Cashme allows you to apply for your loan in as little as 5 minutes with the click of a button.

So if you need quick money, try the Cashme Philippines loan app.

Service Loan Terms & Requirements

Applying for this loan will be simple if the user is a Filipino citizen, over 18, and possesses one or more government-issued IDs. All that is necessary to qualify for this loan is for the customer to demonstrate his reliable source of income. The parameters are pretty adaptable.

The Filipino citizen must have a steady source of income for a minimum of six months or must be working on a business that is becoming profitable. In addition, one or more government-issued IDs are required to apply for this loan period.

Cashme Example of Calculation

The cost of withdrawing funds will be determined by each client’s selected type of loan. For example, if the limit per client is 5,000 pesos with a term of one year and an interest rate of 14 percent, the total cost would be (5,000 pesos + 80-180) * 14 percent = 5,700.

How To Repay Cashme Philippines Loan

If you received a loan online, then the question of ways to repay the debt does not arise. You will receive details that will allow you to repay the debt. The transfer is made from your card to the account of the microfinance organization. It is a relatively simple method of calculation.

The methods of calculation should be discussed in advance. For the company to know that the money is being transferred from a specific debtor, it is necessary to use one method. Moreover, if it is a transfer from a bank card, it must be issued in this person’s name.

Cashme Contacts & Additional Information

If you need to contact the Cashme support team, you can do it with the next contacts:

| Company | Hupan Lending Technology Inc. (brand Cashme Philippines) |

| Website | https://www.cashme.ph |

| Phones | 09453410327, 09066914908, 09059152397 |

| hupanlending2019[@]gmail.com | |

| Office address | Petron Megaplaza is 358 Sen. Gil J. Puyat Ave, Makati, 1227. |

Cashme Reviews

Different Cashme Philippines clients had different experiences of using loans from this platform. Some of the reviews are good, and some are negative. It is always worth checking the lender carefully before taking money from him. According to some users, services from this platform are a reliable and very effective way to quickly improve your financial situation and top up your bank card account.

FAQ About Cashme in the Philippines

To successfully apply for a loan, you should always know a few more details about the company you want to borrow money from.

⭐ What Do You Know About Hupan Lending Technology Inc?

A financial platform called Hupan Lending Technology Inc., commonly known as Cash PH, is created for online small-amount cash lending in the Philippines and may be operated at any time, anywhere using a mobile application.

Cashme provides rapid loans to hundreds of thousands of Filipino consumers. The Philippines’ Cashme banking platform was created for use online.

⭐ Is Cashme Philippines legal?

The list of credit companies has Cashme in the lists of legal creditors. The main characteristics of this platform are:

Company name: Hupan Lending Technology Inc.;

Anniversary: January 23, 19;

Power of attorney: 28791;

Interest rates: 0.80%;

Registration number: CS201901197.

⭐ Advantages and Disadvantages of Cashme?

The main advantages of this platform:

– Money in the shortest possible time.

– There is no longer any need to collect all the documents that the bank requests for opening a loan and wait a long time for a decision — just 15 minutes and money on your bank card;

– Absence of bureaucracy. You don’t need a whole stack of documents. You can apply for an express loan online with only your ID;

– Money for any needs. Cashme will provide you with cash for any requirements; you don’t need to explain anything and look for a good reason for the loan.

The main disadvantage can be considered relatively high credit rates compared to banks.

⭐ What Should You Know Before Applying For an Online Loan?

– Do not rush to sign documents and take out an online loan, even when relevant reviews about the company’s activities have been studied or memorized. Even under such conditions, several nuances should be paid attention to.

The most important points to pay attention to when applying for an online loan include the following:

– Repayment terms should be entirely suitable for the client of the microfinance organization and be fair and transparent. Find out in what specific period the debts must be paid;

– Amounts of monthly payments – it is essential to understand exactly what components make up monthly payments, how interest is calculated, and how much they are charged;

– Penalties – everyone needs to know the number of fines, even those who are 100% sure they will not need this information.

– Situations are different; therefore, just in case, it is worth studying what sanctions await a client who has delayed payment and automatically turned into a debtor in the eyes of the creditor company. In the future, this will keep you in good spirits and make you take the loan much more seriously.

Resume About Cashme Service

Cashme is a company that offers loans to people who wish to spend funds on numerous things and don’t have the money for it. People with good credit scores can get up to PHP 12,000 worth of loans from Cashme Philippines. The loans are offered based on how bad your credit score is, and the interest rates vary with it.

There are always penalties for late payments, ranging from PHP 20-200 depending on the amount overdue and how late it was in making the payment. If a person defaults on their loan, they will never be able to borrow anything else from this company again. Cashme also offers car loans, home equity lines of credit, personal lines of credit, and other types of loans.

Hupan Lending Technology Inc.

Name: Cashme PH

Description: Cashme Philippines is the brand of Hupan Lending Technology Inc. company. The service has loan apps for iOS, Android, and Huawei devices. With this help of them, Filipinos can get the money very fast online. It is an unsecured loan, so, please read all terms before applying for such loans. Also, don't forget to repay debt in time, cause in another case you could get more problems than you had before applying for a such an unsecured loan. So, you can apply for such a loan, but only if you have really urgent need.

Summary About Cashme Philippines

Cashme Philippines provide a financial loan solution for people in the Philippines, but we recommend using it only for very-very-very urgent need. Also, don´t forget to compare one service with other loan companies like Tala, Cashalo, OLP, Digido, Finbro, Moneycat, Kviku, Cashxpress, etc.

Besides, if you can avoid applying for a loan online – choose this way, cause when you spend money that you have taken from the lender it is one thing, but you will repay the loan with your own money and usually it is not easy at all.