Digido Philippines - 0% interest rate for the 1st time loan up to PHP 25.000, if borrower pay back in due time. Apply loan online with Digido and solve your urgent financial issue right now. If you need cash loan in a 15 minutes, Digido is the right solution.

CashXpress Philippines (CXPH) - apply loan online and get you money on bank account in 10 - 15 minutes.

Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

Finbro Philippines is a reliable micro finance company that can solve urgent financial issues in 15 minutes for people all over the country. Apply for the 1st loan up to PHP 15.000

OLP or Online Loan Pilipinas - apply your online loan 24/7. Your loan can be for any purpose, just read terms before, and, if everything ok, get your money with the help of microloan company.

Moneycat Philippines is the online lender which provides fast salary loans for Filipinos. First loan with the 0,01% interest rate. For repeated loan is up to 11,90% per month. You can apply a loan online where never you are.

Kviku is the international lender that support online loans in the Philippines. The number of service customers constantly growing. Kviku provides installment loans for Filipinos. Want to know mode details? Follow the AdvanceLoans.ph article and find out more about this finance service: how to register, what are the terms, reviews, requirements, etc.

SEC issued a new update about online lending companies in the Philippines. 19 lending apps got into the blacklist.

The reason for such a situation followed a great number of complaints from Filipinos caused by invasion of people’s private life or even harassment situations.

Table of Contents

19 Lending Apps In The Philippines That Under Regulation

Service and online application owners do not have the necessary licenses or certificates for the provision of credit services. Also, they do not have the necessary registrations in the SEC, so their operations in the Philippines are outlawed.

These companies/services/apps used customers’ information without their consent in the way one was publicly shamed, etc. The main point of the online lending problem in the Philippines, is that it is not only data violations, but there are also next things why people are unsatisfied with one:

- High-interest rates

- Not normal terms and conditions

- Misleading users and untruthful information

- Privacy violations

- Improper credit collection methods

Instant Pera

Instant Pera is an online lending service in the Philippines. Check to please the review. If to be short, not enough information on the website and social networks.

QuickPera

QuickPera is the Philippines P2P service. One provides loans for up to 3 months. Max. loan amount PHP 25,000. Read full review.

Lendmo Philippines

Lendmo Philippines – is also a P2P service, which is closed currently after SEC regulation. Service has enough large support on Facebook, with over 5000+ followers.

Umbrella App

Umbrella – is one more mobile App for Filipinos. All terms about the one you can read here. You can try using it, but SEC doesn’t recommend it.

QuickPeso App

QuickPeso short review, read please it, and write in comments your opinion about one.

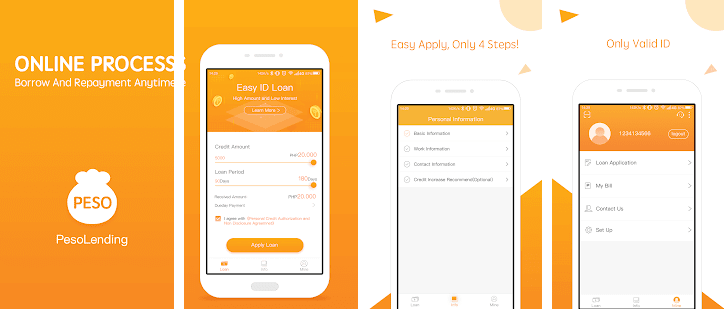

PesoLending

Pesolanding App is already deleted. But information about it you can find here.

Binixo Loan Broker

Binixo Philippines – is not a lender, just a loan comparison website, where you can get information about loan originators.

CashBus App

CashBus – one more lending application in the Philippines (full review).

Cashcat Comparison Website

Cashcat Philippines – is also a loan comparison website, not loan originator company. Service just compares financial service products: banks, loan services, etc.

Cashuttle App

Cashuttle – online application is already closed by SEC. The company provided unsecure fast online loans in the Philippines. 5 minutes to apply, 1 day to receive money.

Crazy Loan

Crazy Loan service is already closed by SEC too. One more lending application that provided unsecured cash loans online in the Philippines.

Flash Cash App

Flash Cash – loan application in the Philippines. We see the current application is active but supposed to be banned by SEC. It is one more app, which can provide Filipinos with unsecured loans online.

Meloan App

Meloan – is banned by the SEC lending applications. You don’t need collateral. Services provided loans for employees and students in the Philippines. The service website is strange enough and doesn’t have information much. Before, Meloan’s max loan amount was: PHP 10000. Loan period: 30 days. Feedbacks were different, but a lot of people also were disappointed with one service.

Happy2Peso App

Happy2Peso Loan application is not working already, but before customers could get loans up to PHP 20000 for 91 – 180 days in Manila and other Philippines cities.

Hatulong

- couldn’t find any information about Hatulong loans service in the Philippines, so “-“

MoneyTree Quick Loan

MoneyTree Quick Loan in the Philippines – online lending service which provides payday loans for Filipinos up to PHP 10000. Service was also banned by the SEC. Also, the website is a little bit strange: advertisements, empty links on social profiles, etc. Check review.

Pera Express App

Pera Express Philippines – is an android loan application, a platform for solving Filipinos’ financial problems. Users could apply for a loan up to PHP 10000, period: 91 – 120 days; max interest rate = 14% per year.

Pera4u App

Pera4u – lending application is also banned, nothing interesting or special. You can try to find some more information about Pera4u, but this app is already closed.

Peramart App

Peramart – again lending mobile application. Customers can apply for the loan up to PHP 10000, loan terms: 91 -365 days, max. interest rate is 24% / year (0,06% per day); no transaction and service fees; no collateral. Application is also banned by SEC in the Philippines, so better work only with reliable services.

Additionally

Credit services received personal information through mobile applications: contact information, contacts, payments, etc. Quite a lot of complaints about services were due to pressure on people to return the money, which negatively affected their personal life, image, and health.

FinTechAlliance.ph initiated the creation of an industry-wide code of ethics to improve the online lending market in the Philippines and improve the situation.

FinTechAlliance.ph – is the finance organization including next companies: PayMaya, Smart, Cashalo, Grab, Mynt, Multisys

and Coins.ph.

The Code of Ethics prohibits the use of bullying and other abuses. Lenders’ and borrowers’ cooperation should be based on the transparency of all conditions and be under the laws: open information on interest rates, truthful information on repayment methods, adequate conditions in contracts, etc.

New Bans from SEC 24.09.19

The Philippine Securities and Exchange Commission is reviewing more than 64 mobile lending applications since they have received a large number of complaints.

Today, Fintech helps to bridge the difficult gap for those who cannot use the services of banks, but some companies fool customers. Therefore, the SEC has already requested Google to block more than 30 different credit mobile applications.

- Cash Wale

- Cashafin

- CashMaya

- Cash100

- Cashope

- Peso2Go

- Cashwarm

- ET Easy Loan

- Creditpeso

- Cashwow

there are more apps out there advertising 90-365 days term but in fact it’s only 7 days example is the loan amount is 4500 the payable ount on the 7th day is 4355 then try will dived the remaining payments wc are below 100 php in the remaining days so it will appear to be 90 days but they will harras u f u don’t pay on the 7th day. most of them also are charging almost 50percent of the loanable amount to service fee att fee, transfer fee etc. then the net amount u rcv is about 50 percent only of the loan. (moca moca, panaloan, surity cash, peoin zippeso,loanmoto,pesohaus,peso buffet, peso online) and many more. these short term lending apps are flourishing the market at lalong nababaon sa utang Ang mga tao instead na nakakatulong sila, at manghaharass pa

Did you find this review helpful? Yes No

Isa po ako s mga naghihiram thru online utang ,may iba .ilang Beses na me nakaloan Pero dumating po ngyn n medyo nahirapan me bayaran ung nahiram ko paunti unti nababayaran ko cla Pero before nun super stress and nadepress na iniisip ko magsuicide dahil s mga collector or agent n yan meron p po clang text na ipapmassacre Nia dw po ung buong pamilya ko and pati mga anak ko grbe po ung emotional damage na ginawa po nila skin lam ko umutang me Pero di ko nman tinatakbuhan un Pero hndi nman ata Tama ung mga pinagsasabi nila

Did you find this review helpful? Yes No

sobra po sila mang harrass,mang threat na ippapatay..porke ippost ka na wanted at druglord,pinag hahanap ng pulisya etc….

sa laki ng interest at liit lang ng halaga na nkuha mo,grabe na yung mga text blast nila na parang milyon ang nahiram mo.

they are illegal agent collector.

Did you find this review helpful? Yes No

Please Help me Legal po ung Online Loans Pilipinas Lending and Pesoreede ang lake tlga ng Interest nila grabe KPG HND KME NKABYD. Mgrereport sila sa Sss Ban Dw yung account ko pati ask ko po kung pupuntahn pob ako sa Bahy Kpg hnd ako nkbyd

Did you find this review helpful? Yes No

CASHBEE PESOQ FLYPESO and other online apps na once di ka makapagbayad sa duedate nila grabe cla maangharass sa text at tawag… i receive DEATH THREAT sa CASHBEE at PESOQ na ipapatay nila buong pamilya ko esp mga anak ko… pti sa NBI irereport nila aq… grabe ang panghaharass nila… at pang iinsulto… emotionally damaged ginagawa nila sa tao… nag apply nga walang binabayarang fee pero grabe sa laki ng interes… halos kalahati lang sa niloan ang nakuha mo…

Pros

Cons

Did you find this review helpful? Yes No

That´s why better use only reliable lenders or don´t apply for a loans at all.

If you see hard collection methods, better to go to police and try to solve all the issues with their help, cause this is not normal.

Fast cash,cash24,cash expresss,Lelpeso,pesohere,suretycash ipeso

yan po mga nangharas sa kaibigan at kapatid ko. naaccess kontak at soc med grabe sila.

Did you find this review helpful? Yes No