Taga Cash loan app you can download only from APK. Service is not

- Loan amount from PHP 2.000 - PHP 20.000

- Loan period up to 120 days

- Interest rate from 1.00% per day (up to 24,00% APR)

- Transaction fee PHP 0

- Citizenship Filipino

- Age 18+

- Requirements Major ID + valid mobile phone

- Who can apply loan Employed person or with stable income

- Sec Registration No. CS 2020100002616-03

- Certificate of Authority No. 3333

- Easy to apply a loan with Taga Cash mobile application

- You can get money quickly in several clicks with the loan app

- Also, you can repay the loan easily, just track your due date with the Taga Cash App

- Enough high loan amount for the micro-finance service in the Philippines

- Better terms for the current customers

- Not secure

- Not transparent terms

- No website and app doesn´t present in the Google Play

- Lot of negative reviews and Filipino testimonials

- Some harassment stories connected with Taga Cash

Taga Cash Loan App provides quick loans in the Philippines. You can get up to PHP 20.000 with one app. You should know that this is an unsecured loan for a short period. Currently, the service is not presented in Google Play, has no website, and enough suspicious compared with other lenders like Digido, OLP, Finbro, etc.

Table of Contents

Taga Cash Loan App Philippines

If you want to download the Taga Cash app, you need to go only to the special site and get apk. It is not safe as it was in Google Play, so pay attention to it. If you install the Taga Cash Loan apk, one will have access to all your personal information on your phone.

- Decide if you really need an online loan;

- Download the Taga Cash app;

- Install and open the mobile application;

- Go through the registration process;

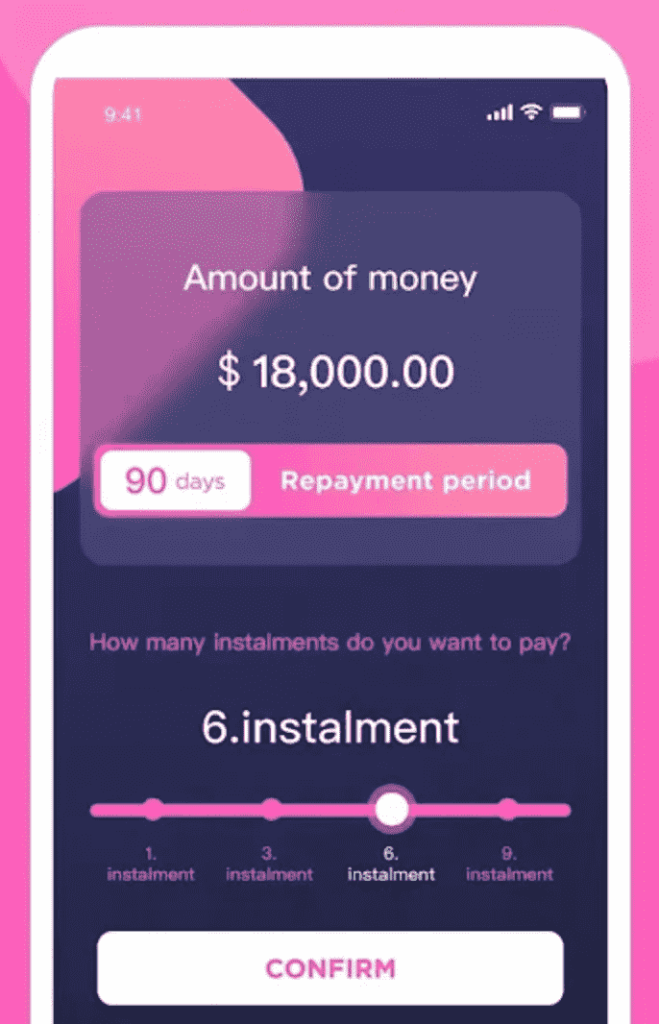

- Choose the loan amount and period;

- Add your personal information;

- Read the terms;

- Get your money – money will be disbursed asap, so you will be notified via SMS, Email and the loan app;

- Repay the loan in time before the due day in order to avoid Taga Cash harassment.

So, how to receive your money with TagaCash:

- You can do it via cash stores;

- Via GCash

- Via bank account

- With the help of M. Lhuillier or RD Pawnshop

Lender´s Contacts

| Company | E-Borrow Lending Corp. |

| Website | no |

| csrtagalending[@]gmail.com | |

| Phone | n/a |

| Address | Rock well Bldg. Hidalgo Driver. Rockwell Centre, Poblacion Makati |

Taga Cash Review

Well, we have found some reviews on the Internet about the services and only negative feedback. For example, check one on Facebook. Also, you can read more about Taga Cash on the National Bureau of Investigation website.

Questions About Taga Cash App

For those who has additional questions:

✓ Is Taga Cash Loan App Legit?

No, loan service is not legal. No information about one in the SEC Philippines.

✓ What Are The Alternative Loan Services To Taga Cash?

Try Digido, Moneycat, Online Loan Pilipinas, Kviku, Finbro, Cashxpress, etc.

✓ How To Repay Taga Cash Loan?

You can do it via the following options:

1) Bank card

1) 7-Eleven, RD Pawnshop, MLhuillier;

2) E-wallets like GCash, etc.

E-Borrow Lending Corp.

Name: Taga Cash

Description: The Taga Cash loan app allows you to get quick money online in the Philippines. The terms are not so good as banks provide, but some urgent needs could be possible.