Digido Philippines - 0% interest rate for the 1st time loan up to PHP 25.000, if borrower pay back in due time. Apply loan online with Digido and solve your urgent financial issue right now. If you need cash loan in a 15 minutes, Digido is the right solution.

CashXpress Philippines (CXPH) - apply loan online and get you money on bank account in 10 - 15 minutes.

Loanonline Philippines doesn´t provide loans. Service only recommends the best options for it to Filipinos.

Finbro Philippines is a reliable micro finance company that can solve urgent financial issues in 15 minutes for people all over the country. Apply for the 1st loan up to PHP 15.000

OLP or Online Loan Pilipinas - apply your online loan 24/7. Your loan can be for any purpose, just read terms before, and, if everything ok, get your money with the help of microloan company.

An emergency loan or extra money saved for rainy days when you will really need additional funds immediately is not anything weird. This is an extremely hot topic today especially in the conditions of coronavirus and different natural disasters. The emergency loan can serve as a real shield for covering incidental costs. At the same time, it has certain aims to give a person an additional chance to overcome unpleasant situations quicker as well as to protect him or her against drifting into debt.

We usually promise to store up additional pesos every month for a black day. And it is a wise idea but only one in every ten can do it. Although, you can not be sure this money will be enough to cover what you need: cope with a difficult disease, recover from the environmental incident, for instance, or any other unexpected harm. To be exact, approximately 75 percent of citizens in the Philippines (namely households) are often lacking money, and as a result, they are not able to be ready for any problem like that.

Along with that, the loads connected with renovation, education or health can often appear together with other incidents. We are people and our lives are full of various situations which we are not capable of foreseeing. You can plan every day hundred times but, unfortunately, life often brings us presents and sudden corrections.

Read also: Great Alternatives to a Payday Loan in the Philippines

According to the statistics, only 33 percent of people in the Philippines have an opportunity to collect some savings, the rest need additional financial support. It is essential to have quick access to a certain sum of money when it is necessary. Here is only a very small group of citizens in the country who have reserve funds.

Today, to be financially vulnerable is not good and very problematic. Lack of money causes many inconveniences and great debts. We do not know when we will need this extra money. For this reason, it was decided to prepare for you the list of checked-out and trusted online loan providers in the Philippines. So that everyone could choose the one, it is indispensable. Surely, it will help to escape from the panic state and unnecessary hassle searching the funds. With the help of the below-indicated lending services online, you can get 10,000 PHP per day. S, you see that emergency loan Philippines do exist.

Table of Contents

Emergency Loans In The Philippines

Using private loan services who have already had a stable process with clear and quick solutions, you can apply for an emergency loan online and receive the money you require very fast. Commonly, the process of applying online takes 10-15 minutes to understand that you are welcome to get this money or not.

A very big advantage here is that private lenders really think about the Filipinos who do not have any job, or get some low income per month, as well as those who have problems with a bad credit score or do not know what is loan in general and, consequantly, do not have any credit history at all.

These loan providers are not going to ask you to submit a gazillion of documents that have been traditionally provided in banks. Due to the attitude of private lenders, every applicant has considerable chances to be qualified for an emergency loan Philippines. Wait for the disbursement right after the approval of your application.

It is important to know that online emergency loans imply often higher commissions if compared with those in banks. Moreover, the biggest sum of loan you can take is 20 thousand-25 thousand PHP.

In case of understanding that you need money immediately, you can obtain the cash you require with easy access only through reliable private online lenders in the Philippines. Do not be very fast-paced when going with the loan contract without previous learning the terms and different nuances. Look through the website of the lender you like and read the necessary section carefully. Choose the best option for yourself. Remember, that an emergency loan with easy terms and conditions offered by a leading and reliable moneylender can save your money and help to cope with cash troubles during the day or even quicker.

Pluses

- Swift approval;

- Simple loan application;

- Opportunity to be approved for the unemployed.

Minuses

- Confined max sum of loan

- A bit high commissions.

Be Sure You Deal with a Legit Lending Companies

We all are looking for the quickest solutions to address some of our common troubles in life, but in case of borrowing money, it’s vital to think about the legal responsibility of the chosen lending provider online. No prize for guessing that there are some microfinance organizations in the Philippines (as well as in many other countries of the world) that operate illegally today.

Online lending is becoming very popular in the Philippines. For this reason, there appear a lot of unlawful websites that have been closely monitored and detected in the country by the SEC. Due to their active work, it becomes possible to destroy their unfair work connected with violation of customer privacy.

Still, there is a range of fantastic online loan services in the Philippines that are absolutely legal, reliable, and have thousands of positive testimonials around. It’s known that these very services are much sought after among Filipinos who for certain reasons can not qualify for a cash loan in common banks and the financial establishments owned by the state. Various unknown loan providers who do not care about customers and just want to take advantage of them engaging in unfair activities. That’s why everyone should know all the essential information about this or that loan provider, so check, please:

- If it is really legit,

- If the company has any license and documents to prove their right to provide the lending service in the Philippines.

Check if they have a special license delivered by the regulatory body of the country including DTI registration. As a rule, the provider has its offline office inside the territory of the Philippines and every client or a potential loan user can simply come to it and ask any question concerning the conditions.

If it comes to a legit loan provider, the process of applying for and obtaining an emergency loan even from the chosen online lending company will be definitely smooth, safe, and fast. No one will ask you to pay any kind of service fee or something like that in advance.

To apply for an emergency loan online in the Philippines you will need to have:

- Your own ID,

- Proof of address and sometimes of your income.

TOP Lawful lending companies for an emergency loan

Here you will find the best online lenders in the Philippines that work within the local rules and law, and have the necessary registration in accordance with the rules of proper authorities.

- Kviku is considerably popular nowadays among Filipinos as it offers really good conditions for users showing its positive reputation and customer-oriented approach.

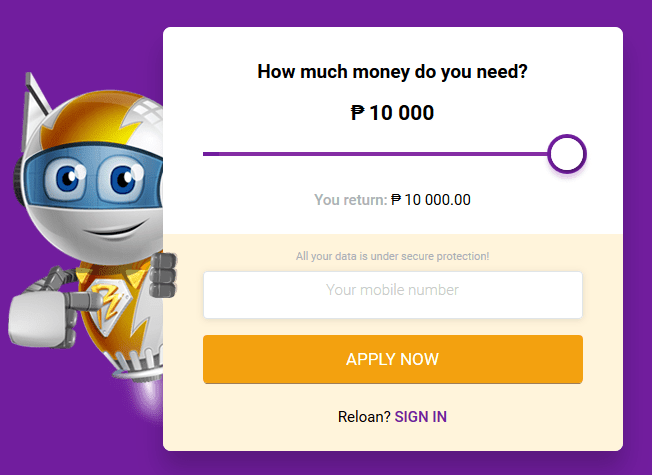

- Robocash has many offices in the Philippines including firm online lending services that work usually smoothly, fast, and automated through great websites.

- Tala has received a reputation as a powerful online money provider. Due to their swift system, everyone can get money per 5 minutes without delays. They also have a user-friendly lending app which is very convenient as well.

- Cashwagon helps clients in the Philippines to apply and get the loan very quickly through the website online or via its contemporary loan app. If the client has already had an account in the bank, it becomes possible for him or her to get the necessary cash loan in several hours. Those who are 20-60 years old and have sustainable income, can take 10 000 pesos for up to half a year.

- Atome has already shown its fantastic lending platform with a convenient system for the residents of the country. The fund disbursement is prompt and the company itself has a good reputation at the market of lending. Moreover, you can use their Android app for applying.

- AdvanceLoans is a very easy to use service which is not actually a direct money provider, but it is considered as an aggregator of the best in the Philippines lending companies. You must admit that it is really very convenient to find all the necessary information about the lending services, their terms, rates, and testimonials about them in one place. Well, it’s a lending-related platform created to tell Filipinos about the best offers and new financial opportunities. AdvanceLoans has also a great blog with useful articles related to the world of finances and money borrowing nuances.

The list of reliable lenders you see above can serve you as a great additional instrument to find what you really need and want. They have already had their reputation, certain history, and many feedbacks. Many borrowers are thankful to them as the services have helped to solve peoples’ financial problems. The most important features they definitely have are simple accessibility of their services and a high level of security.

Different situations can happen in our lives and not usually we can find the solution through the bank or with the help of our relatives or family members. The last one variant is, indeed, difficult psychologically and personally. And private lenders are a great solution in emergency conditions. You can get your money very fast and act right now. Despite the fact they have both pluses and minuses, these services still are considered as the best option for borrowers in the Philippines when it comes to the emergency loan.

Money For An Emergency Case: Family, Friends And Relatives

Residents of the Philippines have such a habit of asking for financial assistance from their relatives and friends. As practice shows when doing this you do not apply any contract or paper with certain terms as you deal with the closest people. It usually comes without any interest rates or, maybe, with the most beneficial ones. You have good relations and are not going to upset them with various charges or fees at all.

When something goes wrong and you fail to repay the money back to your friend, he or she definitely understands you, or not??? It depends…Moreover, you are not asked to give any papers of proof or check your credit history to get some cash (emergency loan) from your family members or close people around you.

It’s a perfect story, you know, all that above is really a good idea but in practice, everything is not usually so. Very often such a story can end damaging your nice relations with the closest. Whether we want it or not, but disputes occur very often concerning repayments and delays.

Emergency Loan Philippines: Final Note

When you discover something goes wrong with your finances and you do need financial assistance, do not grab everything you see or believe it is the only variant, please, learn the lending market and act after that. You can be qualified for several lending options, but not all of them are convenient for you. Research, read testimonials and only after that make your right decision. The list of the checked lenders above is absolutely clear and all of them are licensed by the SEC. The list is not very big, but you need only one provider, don’t you?

Using the opportunities of AdvanceLoans, you can accelerate the general process of search and selection. We show you only the legit companies in the Philippines. Additionally, you will receive fresh, correct and relevant information about emergency loans on the one platform. Take care of your time and relations with the closest!