UnaCash is the the financial loan product for Filipinos. It allows to get the loan online up to PHP 30000. You can get your money up to 24 hour online or quicker.

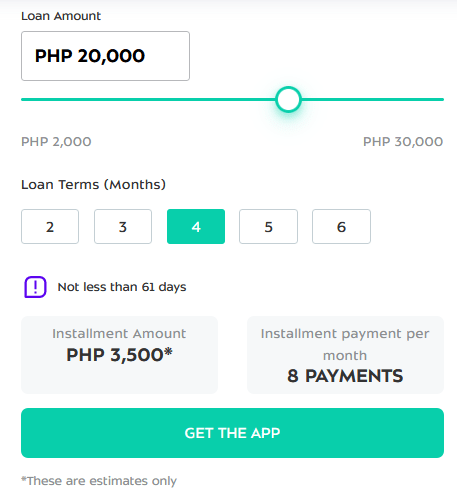

- Loan amount from PHP 2000 - PHP 30000

- Interest rate 3% - 10% per month (depends on client credit score)

- Max APR 60%

- Disbursment fee PHP 0

- Loan terms from 1 - 6 months

- Number of payments 2 times per month

- Age 18+

- Citizenship Only Filipinos

- Prolongation fee PHP 200

- Payment fee PHP 800

- +Daily interest rate if didn't pay in time your due payment 0,33%

- SEC Registration No. CS202003056

- Certificate of Authority No. 1272

- Early repayment available

- Approval time up to 24 hours

- Don't need to visit some ofline office, everything only with mobile

- Easy and fast repayment process

- Can be high intereset rate, if you have poor credit score

UnaCash Philippines – it is the digital loan application which allow you to apply loan online with your phone. It is quickly and convenient, with minimum requirements for borrowers, but instead of it loan companies products have higher interest rates than bank ones. So, be aware about it, check terms and apply the loan with Una Cash when you really need it.

Table of Contents

UnaCash Philippines – Apply Loan

- Go to the website: https://unacash.com.ph or Google Play and find UnaCash app;

- After you need get the mobile application, download UnaCash app and open it;

- Further go through registration process (don’t forget, it is only for Filipinos 18+years);

- Select the loan terms you need;

- Fill in your personal data;

- Send the application and wait for the approval;

- Get you money;

- Repay UnaCash loan in time;

- Use service only when you really need it.

UnaCash Download App

To use Una Cash service you need obviously download android application on your phone. All details about loan will be with you 24/7.

Contacts

| Website | https://unacash.com.ph |

| Application | https://play.google.com/store/apps/details?id=com.robofinance.unacash |

| care[@]unacash.com | |

- Address: Philippines, 15F The IBP Tower, Jade Drive, Ortigas Center, San Antonio Pasig City 1605

UnaCash Reviews

If had already experience to use UnaCash Philippines, please left your feedback in the comments lower. It will be interesting for other Filipinos, so they could better understand how service works.

Questions About UnaCash

⭐ Is UnaCash Legal?

Yes, UnaCash service is legal. SEC registration # CS202003056 and Certificate of Authority # 1272 – UnaCash by Digido FInance Corp.

⭐ How to Repay UnaCash Loan?

You can close your debt with the help of next services:

1) 7-Eleven;

2) UnionBank;

3) The SM Store;

4) M Lhuillier;

5) GCash.

Also, you can pay your debt with the help of your credit card in one of the next banks; BPI, Metrobank, Unionbank, PNB, RCBC, BDO, GCash;

If you want to apply loan again, you need to close previous loan and only after apply the new one.

⭐ Do I need a credit card in order to use Una Cash service?

No need

⭐ What will happen if you can’t pay in time your repayment?

Well, if borrow come to this situation, he/she can ask additional 4 days to find money – costs PHP 200 and make payment, in order to avoid payment fee: PHP 800 + daily interest rate: 0,33%; if you have here additional questions, please write them in the comments lower or just write to Una Cash support team: care@unacash.com;

UnaCash Philippines

Name: UnaCash

Description: UnaCash Philippines - if you need money for the important and asap moments in your life, you can get with Una Cash up to PHP 30000 with minimum requirements. Please, read all terms, and if everything ok, you can continue.

Summary UnaCash

UnaCash is enoug good service, especially if you have good credit score. Cause the interest rate is depending on it and service gives borrowers commission from 3% – 10% concerning one per month. Of cause, if you have bad credit score, your commission will be higher, but in anyway, if you apply and take money, you need to repay them in time, cause if you will be late, no sense in applying quick loans online with Una Cash or any other loan service. Your finance well-being must be at high level. And one more, of you are applying the loan, please read all terms before doing it!

Hi,

What biller name should I select at 711 to pay the 200 pesos for 4 days extension.

Thank you.

Regards,

Arman

Hi, try to find Unacash or Digido Finance Corp.

Unacash brand belongs to this company.

I want to pay today my 1st installment but the cebuana lhuiller have no account on una cash what name do i need to pay my payment thank you.

Hi how to repay the loan? I want to use gcash pay my first payment im a little bit confuse if the generated code should be use or the PN? And is biller name to be select is dragon loan? Please help. Thanks

Hi I didn’t receive my account details of my loan from UNACash, what information can I use as a reference for repaying my loan.

how to register this unacash

Very high the interest 50% to your loan

I have a loan of 10,000 in 10 months then I have to pay 18,000. plus

apply 10k

but bigay 1,300peso

then singil nila 700peso intersects 1week. then sabi hindi pwede daw cancel.

Hi,

I can’t proceed with my application when I’m using the app. Can’t go through where filling out field page, it’s just stuck and keep on loading.

The application hangs up. After you apply for a loan, the processing just stops there, it won’t go any further. And at the end it will say check network connection, even though I’m connected to wifi

Strange, maybe some time error, if so, you can try it later or just choose another loan service, for example, Tala Philippines or order Tonik bank credit card with the app.