Moneycat Philippines is the online lender which provides fast salary loans for Filipinos. First loan with the 0,01% interest rate. For repeated loan is up to 11,90% per month. You can apply a loan online where never you are.

- 1st loan up to PHP 10000

- Interest rate for the 1st loan 0,01% per day

- Repeated loan up to PHP 20000

- Interest rate for the repeated loan 1,50% per day

- Max. APR 145%, if was overdue the interest may reach up to 365%.

- Age 20 - 60 yeas

- Documents Only valid Government ID

- Eployment Employed individuals and selected professionals

- Citizenship Only Filipino

- Loan periods 90 - 180 days

- Credit score no matter

- SEC registration CS201953073

- Certificate of Authority 1254

- Simple in use - several easy steps to apply loan

- Enough fast - no more than 5 minutes to register

- Convenient - you don't need to go to a bank, stand in queue and lose time, just send all information online

- Very attentive - MoneyCat will help you to track your loan period

- Safe - all data is secured

- Interest rate enough high

- Risky, if you are not sure to repay the money in time

MoneyCat Philippines – the lending company which provides loans online up to PHP 20,000, but the 1st loan is no more than PHP 10000. MoneyCat PH is a conventional loan service, that allows borrowers to pay flexibly according to their needs.

Very important to be sure what sum of loan do you need. Be exact in your needs and always remember when and how you need to repay a loan.

Table of Contents

MoneyCat Philippines

Money Cat is an international company and currently, it is available in the Philippines. Service will help with your financial matters, so you can apply for a loan online easily.

How to Apply for the Moneycat PH Loan

Get up to PHP 20000 after online registration with MoneyCat Philippines. You can get your loan online, just provide your bank account, ID, and phone number. After application money can be transferred to your bank account in 24 hours.

Well, there are 4 main steps:

- You need to enter the official website: https://moneycat.ph, choose the sum of the loan, period and do sign up by OTP verification

- The borrower will receive a call and after the call, one needs to wait up to 30 minutes to get approval via SMS

- Take your money from the bank card and solve quickly your finance situation

- Don’t forget to repay a loan at once as you can with DragonPay or other systems

Moneycat PH Terms

MoneyCat terms are competitive with other lenders in the Philippines. Service can give you short-term finance solutions in a convenient way.

How to Repay a Loan and Avoid Penalties

Important to say, that you can repay the loan with your card or with the help of AUB Bank Center. You need to go to the Deposit Slips area.

- MoneyCat’s AUB Account: [082-01- 000183-5]

- After you need complete your Deposit Slip and show one to the teller

- Wait for your carbon copy

- Don’t forget to take a photo of a Carbon copy of the Deposit Slip

- Send one to MoneyCat PH support

- Sending add your contract #, it is obvious

If your payment terms falls on the end of the week, better to repay earlier. Late payment will increase the rate you have!

Besides, you can repay the loan with Moneycat PH in the next services:

- DragonPay – Moneycat PH generates an ID which will be sent to you with the payment

- 7-Eleven or other payment centers (LBC, Bayad Center, Robinsons Department Stores, ECPay, etc) in the Philippines which use lifetime ID

- GCAsh, etc

For example, you go to the 7-Eleven in your area and find the Cliqq Machine. It looks like this:

And do next:

- Choose: “Bills payment”

- Click “More billers”

- Then choose “Loans”

- And “Dragon Loans”

- After you need to add all the necessary information like reference # – lifetime ID, contact number, and the amount you need to repay.

- Wait and click “Next”

- Take the receipt and give it to the cashier for payment and one will issue it

Additional Questions & Answers

- If you didn’t receive the money within 24 hours after applying for a loan – please, contact MoneyCat Support Team;

- The same, if you can’t get your OTP password;

- If you set the wrong bank account – the account holder’s name and account number should be the same if not, the money transaction will be rejected;

- If you repay already have your loan, but it is not posted – take a photo of your carbon copy and send it to support[@]moneycat.ph or to the official MoneyCat FB page + add contract #; in 1-2 hours the status should be changed, if not, write again to the support team;

- How to extend the loan period – borrower needs to pay 7% of the current loan amount and charges

- If your loan was declined, you can do next: 1) check all personal info, if one is correct; 2) apply again later, not earlier than 1 hour; 3) choose another loan service.

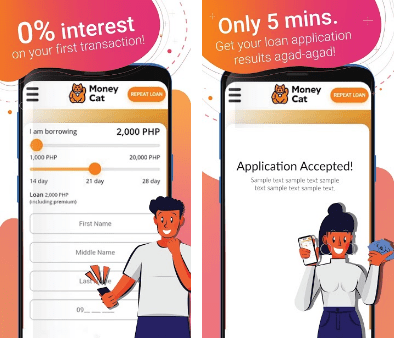

Moneycat PH Mobile Application

We’re surfing the Internet and found Money Cat PH mobile application for Android users. Don’t forget the 0,01% interest rate on your 1st loan, but be careful, and pay in time in order to avoid fines and penalties. You can be 20+ years Filipino and from this age only apply for an online loan. Also, you must be employed!

Currently, it has no high rating, but suppose one is continually developing and OneClickMoney will upgrade it in a better way. By the way, when you applying for the loan with Moneycat Philippines, the service can submit your whole sum or decide on one side how much it can give you. Then you need to decide to apply or not for the loan.

Moneycat Contacts

| Company | Moneycat Philippines* |

| Website | https://moneycat.ph |

| Phone | 190 063 6727 |

| support[@]moneycat.ph | |

| Working hours | 9:00 – 18:00 |

*Registered as MoneyCat Financing Inc: (Formerly: Moneycat Financial Consultants, Inc.):

MoneyCat PH Reviews

If you had already experience to use the MoneyCat Philippines service, please provide your feedback lower in the comments. It will be very useful for other Filipinos.

Those feedbacks we saw, were like this:

- Someone had a salary gap and needed to pay for the rent and in this case, MoneyCat helped much; after, when one got a salary in 1 week, she repays the loan at once

- Another case is about one Filipin guy, who got into trouble cause of a broken car and one needed very much money to solve this issue and MoneyCat PH helped

- The main point is to pay in time, but better don’t use loan service at all

Questions About Moneycat Philippines

✅ Is Moneycat Philippines Legit?

Yes, the company is officially registered in SEC.

> Company Registration: CS201953073

> Certificate of Authority: 1254

✅ How to Apply for A Loan With Moneycat Philippines?

You can apply for the loan with Moneycat Philippines next ways:

With the website

With the mobile application

✅ What Are the Moneycat PH Terms?

3-6 months

up to PHP 20000

Interest rate: 11,9%

Max APR: 145%

⚡ Who Can Apply for The Instant Online Loan?

Only the Philippines citizens

Age: 20 – 60 years

Employed and selected professionals

❓ How Quickly You Can Get The Money?

The time period to get money from the service Moneycat Philippines takes from 1 to 24 hours.

MoneyCat Financing Inc

Name: Moneycat Philippines

Description: Moneycat Philippines - international microloan company presented in the Philippines and providing online loan services for Filipinos who is 20+ years age. Get your loan up to

Moneycat Review

LIked moneycat service. Everything clear and enough options to repay the loan. Need money for asap reasons and repaid in time. As for the interest rate, it could be lower or service could launch promo codes, discounts, etc., but in general ok. I wish everyone to pay debts in time and less use loan services.

Pros

Cons

Did you find this review helpful? Yes (3) No

thru Palawan

Gusto ko humiram ng pera pangbayad sa rent at pangbili ng gatas at diaper

Thru Palawan lang po

Did you find this review helpful? Yes No

extremely high interest rate, almost everyday they will get 116p , i got 5000p loan , nung dec. 2 ,2020- ngayn dec.10 ang ba2yaran ko na eh 7765p,

Pros

Cons

Did you find this review helpful? Yes No