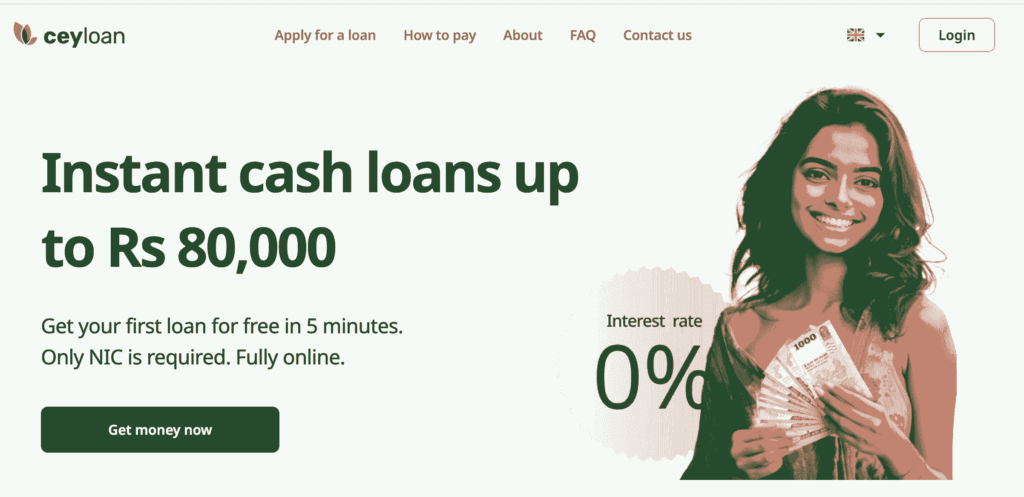

Ceyloan LK - is the lender that provides online instalment loans in Sri Lanka. You can apply up to Rs.80000, but of cause the 1st loan will be with lower amount.

- Loan amount up to Rs. 80000

- Loan period 91 - 180 days

- Interest rate (APR) 182.5%

- Country only for Sri Lanka residents

- Documents only NIC is required

- Age 21 - 60 years

- Employment must

- You can apply for a loan online

- You can use also Ceyloan mobile app (only for Android users)

- Different promotions from time to time

- Service works 24/7

- Seamless application process and repayment experience

- High interest rate

- No app for iOS users

Ceyloan loan in Sri Lanka – get your instant cash loan for an urgent need. Please, read all terms before applying for a loan. You must be sure that terms are ok for you. Also, pay attention that loan period is minimum 91 days, so you should be ready to pay interest for 3 months or more. You can apply for a loan via website or with the help of Ceyloan LK mobile application. All process can take up to 10-15 minutes.

Table of Contents

How To Apply For a Ceyloan Loan in Sri Lanka

With Ceyloan LK you can apply for a loan in 5-10 minutes:

- Go to official lender´s website: https://ceyloan.lk;

- Go through the registration process;

- Choose the loan amount and loan period;

- Add your NIC;

- Read the terms and confirm if one are ok for you;

- Apply for a instant cash loan;

- Get your money on your bank account;

- Repay loan in time.

Loan eligibility requirements at Ceyloan LK are the following:

- Sri Lankan citizenship and residence ✔️

- Age: 21 to 60 years during application ✔️

- Current employment ✔️

- Own bank account ✔️

- For a loan application, simply provide two key documents: your national ID card (NIC) or Driver’s License ✔️

- Active mobile phone number ✔️

After your loan application is approved, you can anticipate the funds being transferred to your bank account in as little as two hours. This swift process ensures timely access to the approved loan amount.

Ceyloan Mobile Application

Secure your FIRST loan with Ceyloan Loan. It is almost free, 0,01% interest, and 0% service fee! Company provides loan solution in Sri Lanka, providing swift online cash loans of up to Rs. 80,000, repayable over 3-6 months. Your funds will be in your bank account within 60 minutes after the application!

How To Repay Lender´s Loan in Time

You can easily repay your loan with the following methods:

- Online via e-wallets: DirectPay, Pay&Go;

- Cash deposit machine: Pay&Go, Sampath Bank;

- Bank online: Sampath Bank, Cargills Bank, bank card;

- Cash via the counter: Cargills Food City, Cargills Bank, Sampath Bank.

Ceyloan LK Contacts

If you have inquiries, feedback, or suggestions? Get in Touch with Ceyloan LK Support Team. Dedicated Ceyloan Support Team will assist you! Customer support operates between 8:30 AM to 10:30 PM.

| Company | CeylonTech Lanka Private Limited |

| Website | https://ceyloan.lk/ |

| support[@]ceyloan.lk | |

| Phone | 0114279800 |

| Mobile app | https://play.google.com/store/apps/details?id=lk.ceyloan.app&hl=en_US |

Address: CeylonTech Lanka Private Limited No 25, Simon Hewavitharana Road, Colombo 3, Sri Lanka

Ceyloan Loan Reviews

If you had already experience with the Ceyloan Loan lender, please share your experience lower in the comments. Was it good or bad, no matter, the main thing it was your true story.

Ceyloan Loan in Sri Lanka FAQ

Is Ceyloan LK Legal Company?

No information about it on the website.

Can You Share a Loan Example?

At Ceyloan Sri Lanka, the company prioritizes transparency. Consider this loan calculation: Approved for RS 50,000 at 18%* APR, your monthly cost is just RS 442. Total repayment in 6 months: RS 8,776. Read our Terms for detailed loan info.

Is The 1st Loan “Interest-Free”?

Your initial loan is interest-free, requiring repayment of only the borrowed principal if the deadline is met. Subsequent loans may have interest charges.

How To Find Out Is Ceyloan LK Loan Was Approved?

Upon loan approval, Ceyloan LK will send you an SMS notification confirming your application’s acceptance. Keep your phone accessible and check messages regularly for timely updates on your loan status.

How To Get Your Instant Loan Again?

For your subsequent loan application, kindly adhere to these steps:

> Ensure timely repayment of your previous loan, establishing a positive repayment history to enhance eligibility.

> Access your personal account through the Ceyloan website or app.

> Locate and click the “Get Money” button within your account.

> Follow the instructions to complete your loan application, providing required details and documents.

> If no immediate offers are available, rest assured, a tailored offer is being prepared.

> Meanwhile, ensure your prior loan payments are fulfilled.

> Stay updated with Ceyloan’s notifications, SMS, and app alerts for optimal loan terms and conditions.

For What Reasons Lender Can Reject Your Application?

Your loan application might be declined due to the following reasons:

> Ensure the accuracy of your provided national ID and its ownership.

> Late payments or defaults with other financial services can impact your creditworthiness.

> Exceeding borrowing limits with existing loans may lead to rejection.

For improved approval chances:

> Update and verify your national ID details.

> Prioritize prompt payments and debt settlement.

> Manage existing debts to maintain a manageable borrowing limit.

Note that lenders have varied approval criteria. If rejected, consider alternative financial options.

CeylonTech Lanka Private Limited

Name: Ceyloan LK

Description: Ceyloan Loan Sri Lanka - lender provide quick instant cash loans on your bank account in 10-15 minutes. All process is online. Try it now. Company is enough new, so no reviews about one. Please, read all terms before applying the loan.

Summary About Ceyloan LK

Company is new on the market and has not enough trust from the people as other lenders have. Need to wait and see how it will work. If people liked it, than this will be a good story. Need more information on the website, possibly you will be able to find out additional options in the online contract.